NOIDA (CoinChapter.com) — Monero (XMR) price continued its sharp upward trajectory this week, extending its April gains amid a broader resurgence in the cryptocurrency market. As of April 28, 2025, XMR price spiked to $328, for the first time since Aug. 2021.

The privacy-focused cryptocurrency decisively outperformed Bitcoin and Ethereum in April. Both posted more moderate gains despite renewed risk appetite across the digital asset sector.

Bitcoin reclaimed the $95,000 level earlier this week following better-than-expected GDP growth data in the U.S., which eased fears of a severe slowdown. Ethereum also stabilized above $1,800 after a volatile start to the month. However, Monero’s price action has been notable, with the token surging past critical multi-month resistance levels while maintaining strong momentum.

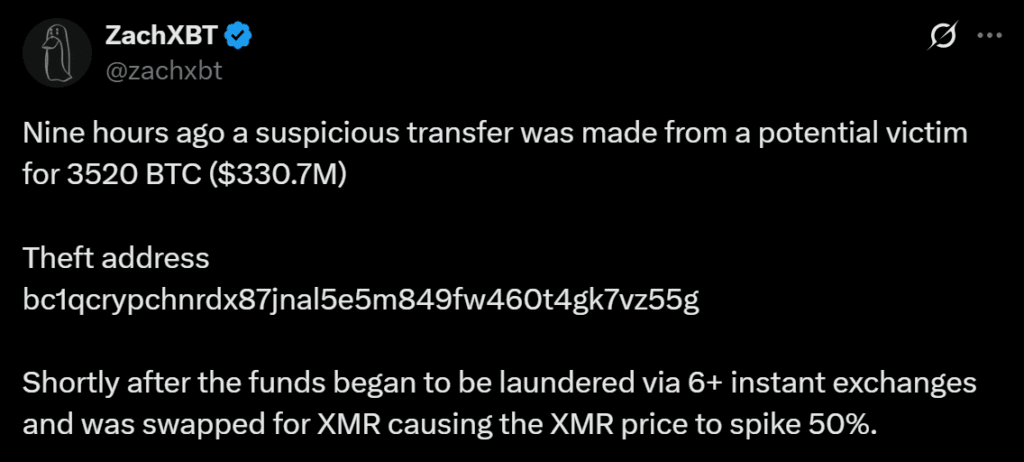

Adding complexity to the narrative, blockchain investigator ZachXBT flagged a suspicious $330 million Bitcoin transfer earlier this week, involving 3,520 BTC reportedly laundered across multiple exchanges and swapped into Monero. While the broader impact of this event remains under review, it may have contributed to the sudden demand spike for XMR during the same period, amplifying its price surge.

Meanwhile, improving macroeconomic conditions and softening Treasury yields have fueled risk-on sentiment, benefiting alternative assets such as privacy coins. XMR, often seen as a hedge against regulatory scrutiny, appears to have capitalized on these dynamics as technical signals hint at a deeper bullish shift. A major multi-year chart pattern seems to have triggered, pointing to a potential larger move ahead.

Funding Trends and Technical Setup Support Bullish Case

According to data from CoinGlass, Monero’s open interest-weighted funding rate turned sharply negative around mid-April. Traders appeared to position aggressively for downside, expecting a price rejection near previous resistance levels. However, the negative funding rate failed to stop traders from likely liquidating short positions under pressure. The move highlights a broader shift in market dynamics favoring buyers rather than leverage-driven speculation.

Simultaneously, XMR futures open interest surged, reaching one of its highest points since early 2025. Elevated open interest and neutral funding rates confirm that spot-driven demand fuels the rally, not excessive leverage.

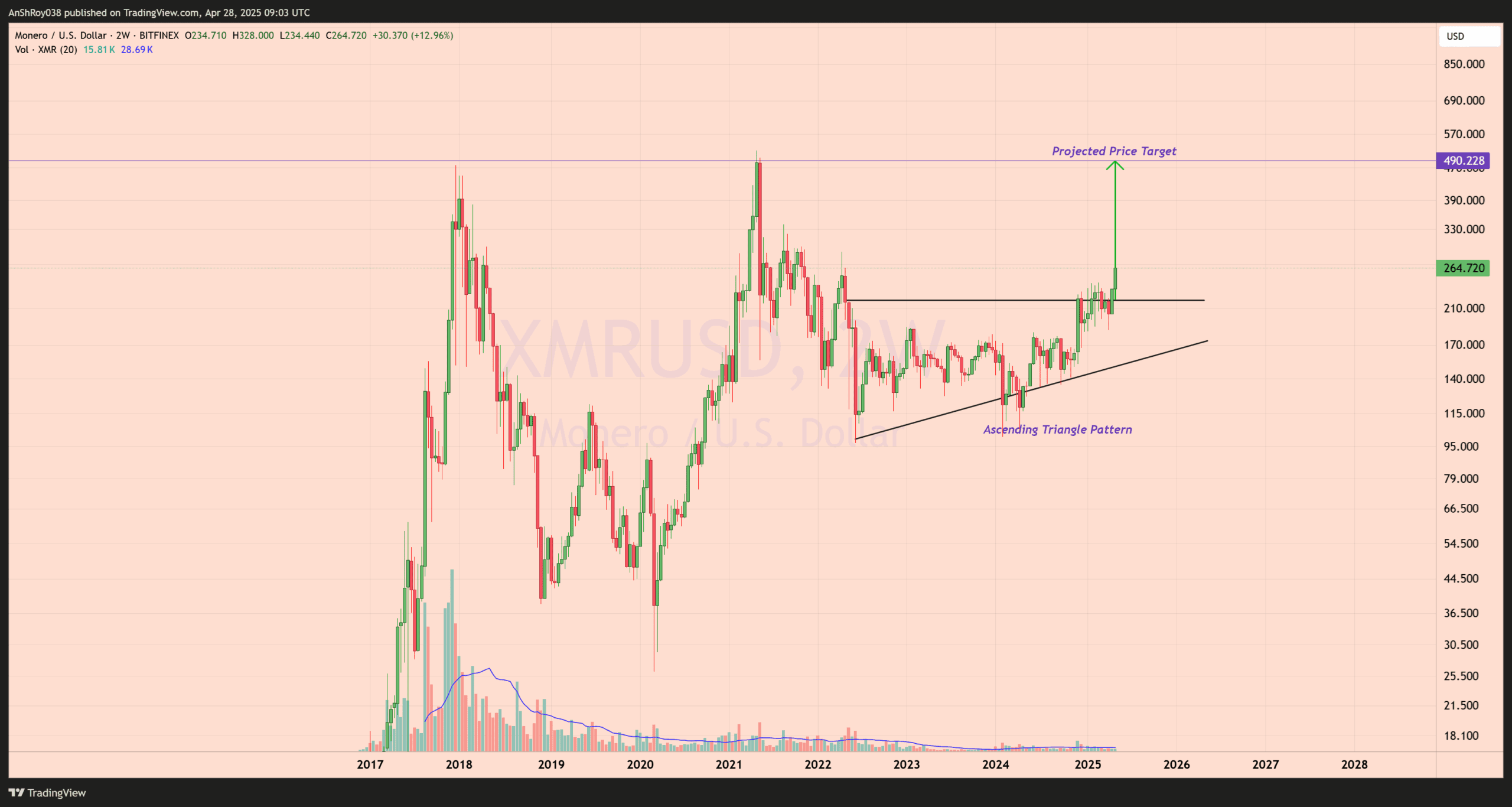

On the spot chart, the XMR price successfully broke out of a long-standing ascending triangle pattern. In technical analysis, ascending triangles typically form during consolidation phases. A flat resistance level and a series of higher lows characterize the pattern.

A breakout from this structure traditionally signals bullish continuation, driven by growing buying pressure each time sellers attempt to defend resistance.

Traders calculated the projected price target for the breakout by measuring the height of the triangle formation and projecting that distance upward from the breakout point. Based on this method, Monero’s structure suggests significant upside potential if momentum sustains.

Although the breakout has materialized on higher timeframes, full confirmation would require weekly closes above former resistance levels and healthy volume expansion. Together, funding, open interest, and technical structure imply that Monero could remain a strong outperformer in the weeks ahead, provided that the broader market sentiment remains constructive.

Monero Faces Initial Resistance After Sharp Rally

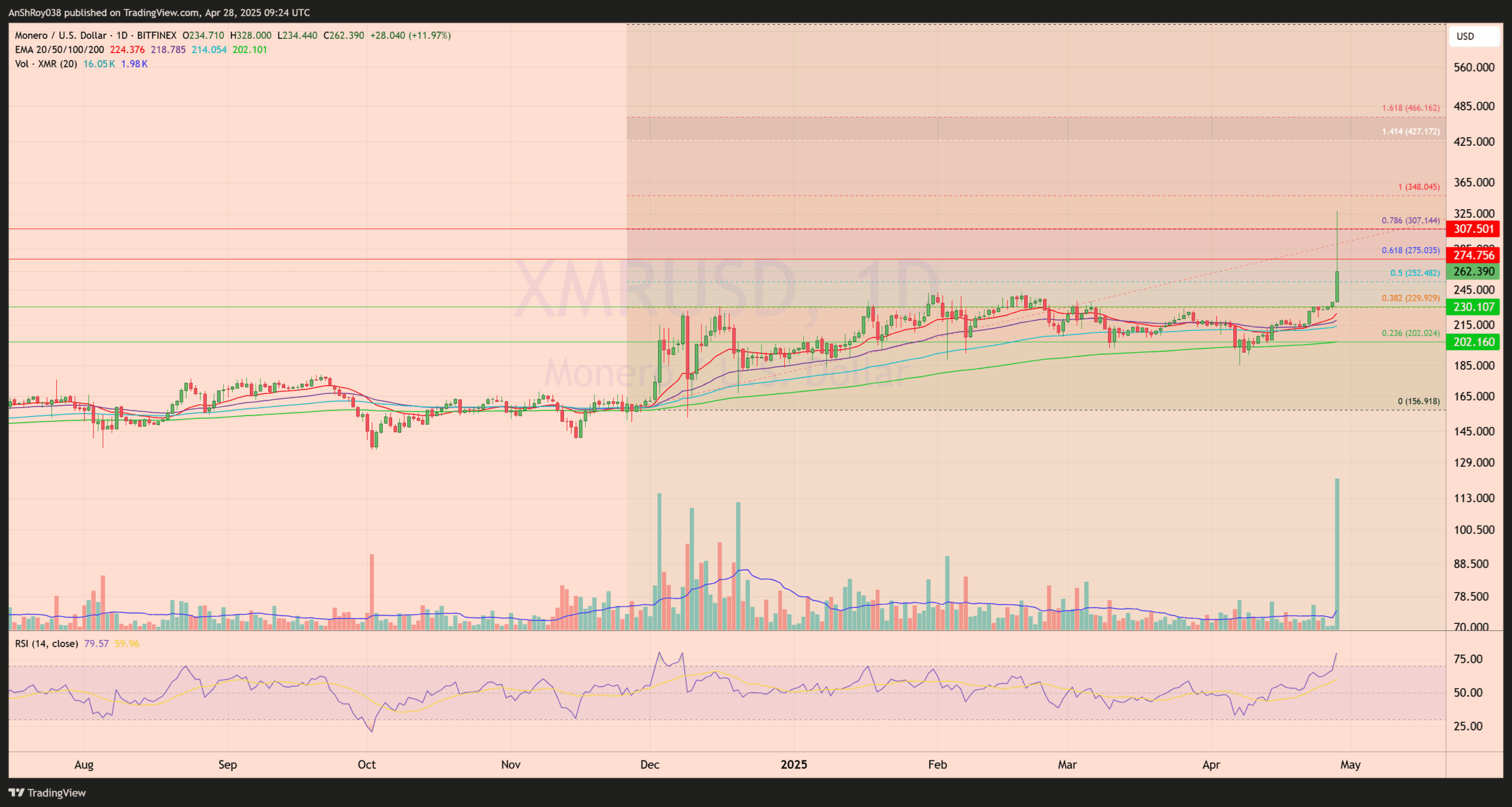

XMR price posted a strong 40% intraday spike on April 28, briefly soaring toward the $328 mark before profit-taking pressure likely forced a sharp retracement. XMR price stabilized near $263, paring much of its earlier gains but still holding significantly above prior consolidation levels.

The daily chart highlights clear technical hurdles for XMR price. Immediate resistance emerges near $275, aligned with the 0.618 Fibonacci retracement level. Above that, a heavier resistance band looms near $307, close to the 0.786 Fibonacci retracement.

Sustained acceptance above these levels would be necessary for Monero to revisit the upper targets projected in its broader breakout structure.

On the downside, key support has formed near $245, where prior horizontal resistance has now flipped into an interim floor. A deeper pullback would bring the next support zone near $230 into focus, corresponding with another visible horizontal pivot.

The 200-day exponential moving average (EMA) continues to provide structural support near $202. Additional shorter-term EMAs, including the 50, 100, and 150-day moving averages, cluster between $215 and $230, adding further strength to the underlying uptrend.

The daily RSI reading near 80 suggests XMR entered overbought territory during the spike, making the current cooling phase a healthy development rather than a breakdown. Overall, the technical structure remains constructive as long as XMR price holds above the $230–$245 demand zone, keeping the broader bullish breakout prospects alive.