Are you looking to invest in cryptocurrencies but unsure which one to buy? With so many options available, it can be overwhelming to decide how to invest your money. That’s why we’ve compiled a list of the best crypto to buy now, based on factors such as project developments, price performance, and market capitalization, as well as the overall potential for growth.

In this article, we’ll take a closer look at the most promising cryptocurrencies, including staples such as Bitcoin and Ethereum, and a combination of several other promising crypto projects. We’ll discuss their features, advantages, and potential drawbacks, as well as provide insights into market trends. Whether you’re a seasoned investor or just starting out, this article will help you make an informed decision about the best crypto to buy now.

So, let’s dive in and explore the best cryptocurrencies to invest in 2023:

- XRP – A leading crypto-powered payment solution

- PancakeSwap – A popular decentralized trading protocol

- Bitcoin – The world’s oldest and largest crypto

- Solana – One of the fastest and cheapest L1 blockchains

- Chainlink – A decentralized oracle network

- Ethereum – The leading DeFi and smart contract platform

- Maker – The DeFi protocol behind the Dai stablecoin

- BNB – The native asset of the BNB Chain and Binance ecosystem

- Optimism – A popular Layer 2 scaling solution

- Shiba Inu – A NFT, DeFi, and blockchain gaming project

- Cosmos – A leading interoperability-focused blockchain project

- Toncoin – A blockchain designed by Telegram and run by the community

Best cryptos to buy right now

The following three cryptocurrency projects highlight our investment selection thanks to important developments and upcoming events that make them especially interesting to follow in the near future. These projects are updated each week based on the most recent developments and trends taking place in the crypto market.

1. XRP

XRP is a digital cryptocurrency that was created by Ripple Labs in 2012. It is used as a means of payment and transfer of value on the Ripple payment protocol, which is designed to enable fast and secure transactions between financial institutions, as well as individuals.

XRP is unique in that it is not based on the blockchain technology used by many other cryptocurrencies. Instead, it uses a distributed consensus ledger called the XRP Ledger, which is maintained by a network of validators. This allows for faster transaction processing times and lower fees compared to traditional payment methods.

XRP has been popular among cryptocurrency traders and investors due to its high liquidity and clear potential for broader adoption, especially as a remittance solution. However, it has also been the subject of controversy and legal action, with US regulators alleging that it is a security and should thus be subjected to securities regulations. This has somewhat hindered the potential of XRP as an investment, and handcuffed Ripple’s growth as a company.

Why XRP?

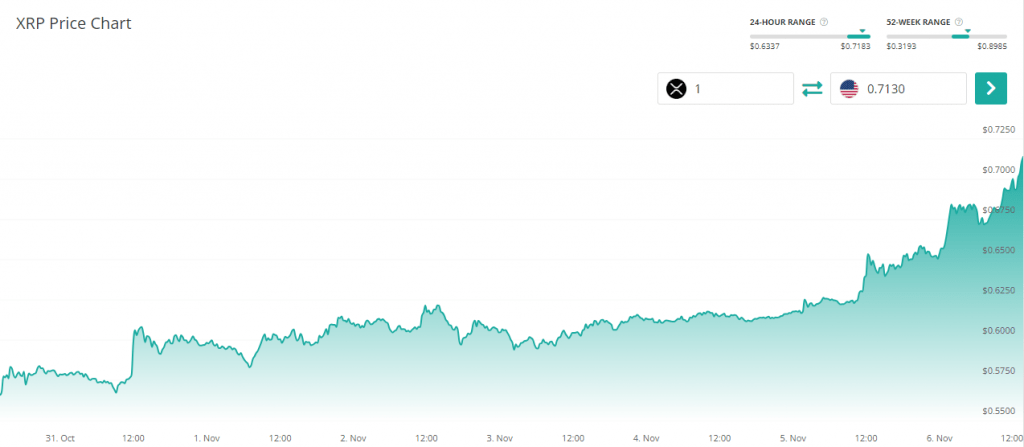

On November 6th, XRP surged by over 11%, reaching a market cap of $38.26 billion. The massive daily price increase has helped XRP displace BNB in terms of market capitalization, pushing the fintech crypto token in the fourth spot, behind Bitcoin, Ethereum, and Tether.

There are several reasons why XRP could be rallying. For starters, Dubai regulators have recently approved the XRP currency, giving businesses in the country the ability to transact with XRP. Second, Ripple partnered with the National Bank of Georgia for a CBDC pilot program last week. “The pilot will experiment with Ripple’s CBDC technology and evaluate the practical use cases to gauge potential benefits for the public sector, businesses, and retail users,” Ripple explained in a statement.

In addition, on September 8th, Ripple announced its intention to buy Fortress Trust, a Web3 infrastructure, compliance, and operations firm. The acquisition is set to expand Ripple’s selection of U.S. regulatory licenses.

The news follows a favorable ruling for Ripple earlier this year. On July 13, the presiding judge in the SEC vs. Ripple case ruled that Ripple’s sale of XRP to programmatic buyers cannot be considered an investment contract. This means the New York court ruled that XRP is not a security when sold on exchanges to non-institutional buyers.

The court’s decision has been heralded by many as a great outcome for Ripple and the broader crypto market. It sets a precedent for other crypto projects, which sold their tokens to investors through token sales on exchanges.

The judge noted that the sale of XRP to institutional investors was a security offering. The sale of XRP in that way should abide by security laws, making Ripple and its founders responsible for an alleged unregistered sale of securities.

2. PancakeSwap

PancakeSwap is a decentralized exchange (DEX) built on the BNB Smart Chain (BSC). It operates similarly to other DEXs, allowing users to trade cryptocurrencies without the need for a centralized intermediary. PancakeSwap is known for its low transaction fees and fast confirmation times, which are made possible by the BSC’s blockchain design.

PancakeSwap is also unique in that it incorporates yield farming and liquidity mining features, allowing users to earn rewards for providing liquidity to the exchange. Users can stake their cryptocurrency holdings in liquidity pools and earn rewards in the form of the exchange’s native token, CAKE.

Launched in September 2020, PancakeSwap has gained popularity as a cheaper and more accessible alternative to other decentralized exchanges like Uniswap, which operates on the Ethereum network and can be more expensive due to the high gas fees associated with the Ethereum blockchain. Last year, the PancakSwap community voted in favor of deploying the DEX on Aptos, which became its second support blockchain other than BSC.

Why PancakeSwap?

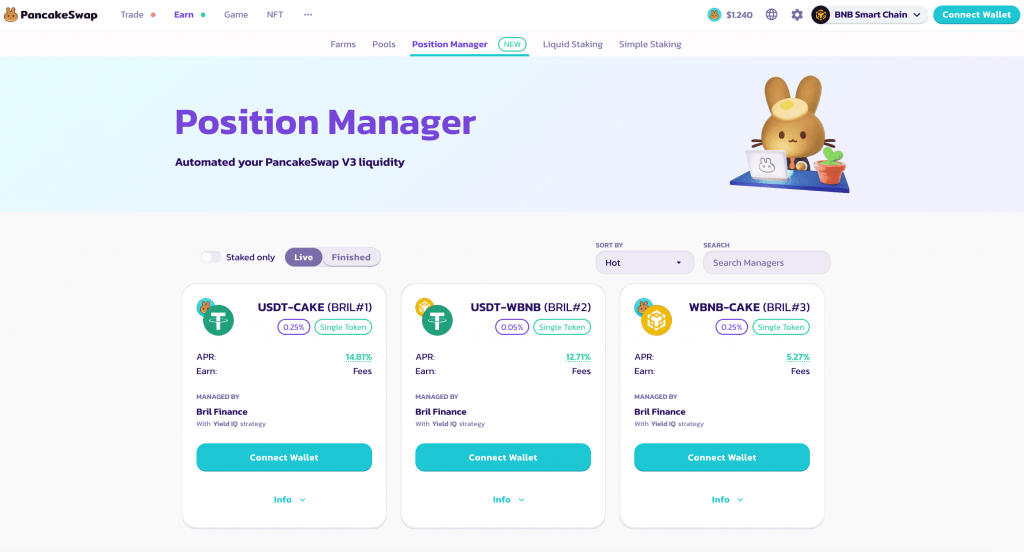

PancakeSwap’s CAKE token surged by +90% in the past week, outperforming all other assets in the cryptocurrency top 100 in the time period. The reason for the large price increase could be attributed to the rollout of the Position Manager feature in collaboration with Bril Finance.

Position Manager is set to streamline single-token liquidity provision in PancakeSwap Farms, offering liquidity providers (LPs) a convenient way to contribute just one token. In return, they can look forward to competitive APRs and a slice of the LP rewards.

Position Manager is powered by Yield IQ, which operates under a self-executing smart contract. It introduces a single-sided concentrated liquidity provision strategy, aiming to reduce divergent losses by making rebalancing decisions based on token composition, rather than token price.

Here’s a brief overview of how Position Manager works in practice:

- Users deposit their chosen tokens into PancakeSwap’s Position Manager using the Yield IQ strategy.

- These assets are then allocated to concentrated liquidity pools within AMMs without requiring token swaps.

- In return, users receive LP tokens representing their share of the liquidity pool.

According to our PancakeSwap prediction algorithm, CAKE could see a massive increase in the coming months and reach $4.75 by the end of March 2024, more than a +100% increase compared to current market rates.

3. Bitcoin

Bitcoin (BTC) is the original decentralized digital currency, enabling peer-to-peer transactions without the need for intermediaries such as banks or financial institutions. It was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin was the first digital currency to eliminate the double spending problem without resorting to any central intermediaries.

Bitcoin transactions are recorded on a public ledger called the blockchain, which is maintained by a network of computers around the world. This means that the transactions are secure and transparent, as anyone can view them, but they are also anonymous, as the identity of the participants in the transaction is not revealed.

BTC can be bought and sold on cryptocurrency exchanges, and they can be stored in a digital wallet, which is a software program that securely stores private keys that are required to access and transfer the currency.

Bitcoin is often referred to as “digital gold” or a store of value, as it has a limited supply of 21 million coins, and its value is determined by market demand. Some people also see it as a hedge against inflation or a way to diversify their investment portfolio. It is by far the largest cryptocurrency by market cap in the industry, accounting for the value of more than 40% of all digital assets in circulation combined, making it arguably the most popular crypto to buy.

Why Bitcoin?

Bitcoin has reached its highest price levels since May 2022, raising hopes that the prolonged bear market might be nearing its end. However, it’s worth noting that the $35,000 price mark has acted as a resistance that the bulls are struggling to overcome. BTC briefly surpassed $35,000 on November 2 and November 5 but quickly retreated.

The positive price movement has drawn investors to the Bitcoin market, as indicated by increased Google search activity. Over the past week, the search term “Buy Bitcoin” has seen a notable spike, based on Google Trends data.

Additionally, the Chicago Mercantile Exchange (CME), regulated by the CFTC in the United States, has become the second-largest platform for Bitcoin futures in terms of open interest. The CME currently holds a notional open interest of $3.54 billion, while the top-ranked Binance stands at $3.83 billion.

The growing influence of the CME in the Bitcoin futures market suggests that institutional investors are becoming a more significant presence in Bitcoin investing.

At the time of writing, BTC is changing hands at $34,980.

With the next Bitcoin halving event approaching (expected to take place in late March 2024), the current price level could allow investors to gain exposure to the coin at a discount before Bitcoin’s price starts to take off. Bitcoin halving is an event that halves the rewards miners receive for each block. In the next halving, the fourth one in Bitcoin history, this reward will drop from 6.25 BTC to 3.125 BTC. It is worth noting that Bitcoin halvings have historically been major price catalysts for BTC and the rest of the crypto market.

Historically, each Bitcoin halving cycle has brought new all-time highs, supporting the argument of those who advocate buying Bitcoin ahead of a halving event. Here’s a quick breakdown of the highest and lowest prices in each cycle, as well as the BTC price at the time of each halving:

| Lowest Price | Highest Price | BTC Price at Date of Halving | |

| 1st Halving Cycle (Nov 2012 – Jul 2016) | $12.4 | $1,170 | $12.3 (Nov 28, 2012) |

| 2nd Halving Cycle (Jul 2016 – May 2020) | $535 | $19,400 | $680 (Jul 9, 2016) |

| 3rd Halving Cycle (May 2020 – Mar 2024)* | $8,590 | $67,450 | $8,590 (May 11, 2020) |

The best cryptocurrencies to invest in 2023

4. Solana

Solana is a cryptocurrency and blockchain platform that was created to provide a fast, secure, and scalable infrastructure for decentralized applications (dApps) and token issuance. It was launched in March 2020 by Solana Labs, and quickly grew to become one of the largest blockchain networks in the sector.

Solana uses a unique consensus mechanism called Proof of History (PoH) which enables it to process thousands of transactions per second while maintaining a low transaction fee. This makes it one of the fastest and most cost-effective blockchains in existence.

In addition to its fast transaction processing speed, Solana also offers smart contract functionality and is fully compatible with the Ethereum Virtual Machine (EVM). This allows developers to build and deploy dApps on Solana using popular programming languages such as Rust, C++, and JavaScript.

The native cryptocurrency of the Solana network is called SOL, which is used as a medium of exchange and a store of value within the ecosystem. SOL is also used to pay for transaction fees and other network services.

Following explosive growth in 2020 and 2021, Solana hit a rough patch in 2022 due to the broader crypto winter. The negative market activity for SOL was exacerbated following the collapse of the FTX exchange, which was one of the biggest investors in Solana. The SOL coin fell all the way down to $10 in late 2022 (95% removed from its ATH of ~$260) but has since recovered some of its losses.

Why Solana?

Solana has shown an impressive performance recently, with a substantial 71% gain against the dollar in the past 30 days. This achievement ranks as the third-best performance among the top 100 cryptocurrencies in the last month.

It’s not just retail cryptocurrency investors that see potential in Solana, but institutional investors as well. The asset management firm called VanEck has released a report emphasizing Solana’s long-term potential.

They point out Solana’s exceptional data throughput, which it a strong contender for a potential “killer app” on the blockchain that could cater to a global audience of 100 million users. However, it’s important to note that whether such a killer app will emerge and attract a massive following remains uncertain.

According to the report’s most optimistic scenario, SOL’s price could reach an impressive $3,211 by 2030. In a bearish scenario, the token is projected to trade at $10, while in a more moderate base scenario, it is estimated to be priced at around $335.

5. Chainlink

Chainlink is a decentralized oracle network that acts as a bridge between smart contracts on blockchain platforms and real-world data. Its primary role is to ensure the reliability of data used in smart contracts by connecting to multiple data sources, reducing the risk of data manipulation or failure. This enhances the versatility of smart contracts, allowing them to access and utilize a wide range of external data sources and services beyond their native blockchain environment.

One of Chainlink’s notable features is its security model. It relies on a decentralized network of nodes to fetch and validate data, eliminating the single point of control or failure. However, there are concerns about centralization, with some major node operators having substantial influence in the network. Additionally, integrating Chainlink into smart contracts can be complex, potentially posing challenges for developers.

Chainlink acts as a crucial intermediary, enabling smart contracts to interact with real-world data. It enhances data reliability, expands the potential use cases for smart contracts, and relies on decentralization for security. Nonetheless, concerns about centralization and competition are factors to consider in its ongoing development and adoption.

Why Chainlink?

Over the past week, LINK gained over 35%, outperforming most assets in the crypto top 100. The reason for the large price increase and potentially continued rally is the announcement of the Chainlink Staking v0.2.

According to the team, version 0.2 of the staking platform will provide greater flexibility, improved security, seamless future upgradeability, and dynamic reward mechanisms.

In addition, Chainlink announced a partnership with the Depository Trust & Clearing Corporation (DTCC). The collaboration is focused on SWIFT’s interoperability project, which is exploring “standardization in blockchain interoperability, by showcasing how financial institutions and FMIs can utilize their existing Swift connection in combination with Chainlink to instruct the transfer of tokenized assets across public and private blockchains.”

The series of announcements follow a major launch of the Cross-Chain Interoperability Protocol (CCIP) on Chainlink mainnet in July 2023, which provides a streamlined interface for dApps and Web3 companies to transfer data and tokens across different blockchain platforms.

As a result of these initiatives, the native coin of the Chainlink chain rallied by over +35% in the past week and reached an 18-month high above $10.85 on Monday. LINK is currently trading about -81% removed from its ATH, so there’s still room for growth, especially if the broader crypto market continues to show bullish activity.

6. Ethereum

Launched in 2015 by Vitalik Buterin and a team of developers, Ethereum is a decentralized, open-source blockchain platform that allows developers to build decentralized applications (dApps) and smart contracts.

Ethereum has a wide range of use cases beyond just a store of value or medium of exchange. Ethereum’s smart contract functionality allows developers to build dApps that can run without the need for intermediaries, like centralized servers or institutions.

The Ethereum platform has gained widespread adoption and has become the backbone of the decentralized finance (DeFi) industry. DeFi applications built on Ethereum allow users to access financial services without relying on traditional banks or financial institutions. Ethereum’s smart contract functionality has also enabled the creation of non-fungible tokens (NFTs), which have gained popularity in the digital art and gaming worlds.

While Ethereum has a strong community and has been highly influential in the cryptocurrency industry, it also faces challenges, such as scalability issues and high gas fees. These issues have spurred the development of various Layer 2 scaling solutions. In the long run, future updates are supposed to massively increase Ethereum’s throughput bringing the transaction per second (TPS) figure from 15 to 100,000.

Why Ethereum?

ARK Invest and 21Shares, two prominent investment firms in the crypto space, have filed their respective applications with the Securities and Exchange Commission (SEC) for Ethereum futures ETF products.

Ethereum price tracking futures ETFs (“ARK 21Shares Active Ethereum Futures ETF (ARKZ)” and “ARK 21Shares Active Bitcoin Ethereum Strategy ETF (ARKY)” m respectively) will give institutional and retail investors another venue to invest in ETH futures beyond the current offerings provided by centralized and decentralized digital asset exchanges. In practice, the new investment vehicles could attract new investors to the space and elevate the liquidity of Ethereum spot and futures markets.

The ETH futures ETF news follows the launch of Base, a layer 2 scaling solution for Ethereum built by Coinbase. Unlike some other platforms, Base has not introduced its own token; instead, it is using ETH itself as a gas token.

Launched on August 9, the release of the Base layer 2 solution, constructed upon Optimism’s OP Stack infrastructure, has given users the option to bridge their ETH from the Ethereum mainnet to Base.

In celebration of Base’s launch, Coinbase launched the Onchain Summer event, showcasing various blockchain projects spanning art, gaming, and music. Participants stand a chance to benefit from daily drops from a range of projects being developed on the Base platform.

While Base holds the potential to rejuvenate the Ethereum ecosystem, it’s essential to note that ETH’s recent price performance has been lackluster as of late. Over the past month, the second-largest cryptocurrency has maintained a relatively narrow trading range, fluctuating between approximately $1,620 and $1,870. In this 30-day period, ETH has registered a hefty -12.5% price change against the US dollar.

7. Maker

Maker is a decentralized finance protocol on the Ethereum blockchain that issues and manages Dai, a decentralized stablecoin pegged to the US dollar. Users that hold assets that are supported as collateral (for example, ETH) can lock their coins into Maker’s smart contracts in order to issue Dai.

The system is overcollateralized—in order to mint Dai, users need to provide collateral that exceeds the value of minted Dai, and users are required to monitor the value of their collateral in order to avoid liquidation.

The MKR token is used as the governance token for the MakerDAO, a decentralized autonomous organization that oversees the Maker protocol.

MakerDAO was founded in 2014 by Rune Christensen, and the Dai stablecoin was launched in late 2017. Initially, the Maker protocol only supported ETH as collateral. With the launch of Multi-Collateral Dai in 2019, it also became possible to use other forms of collateral. Today, Dai is backed by a diverse range of assets, including ETH, (wrapped) BTC, USDC, USDP, and many others.

Why Maker?

Maker has been one of the best-performing cryptocurrencies in the top 100 in 2023, gaining +180% since the start of the year. There could be additional upside for MKR going forward, as new data shows significant whale activity surrounding the token.

According to crypto analytics firm Loononchain, “3 whales are accumulating MKR”. In the last 48 hours, nearly $4 million worth of Maker tokens have been withdrawn from exchange wallets on Binance and OKX.

Generally speaking, digital assets leaving the exchange is considered a bullish sign. Usually, whales are depositing crypto on exchanges when they intend to sell them and withdrawing when they plan on holding them for a longer period of time.

At the time of writing, Maker is trading at $1,468, up +3.75% in the last 24 hours.

8. BNB

BNB (formerly Binance Coin) is a cryptocurrency created by the popular cryptocurrency exchange Binance. Binance is the largest cryptocurrency exchange in the world, allowing users to buy, sell, and trade a wide range of digital assets.

BNB was initially one of the ERC-20 tokens on the Ethereum blockchain but has since migrated to its own blockchain, known as BNB Chain. BNB is used as a utility token within the Binance ecosystem and has a variety of use cases. For example, users can use BNB to pay for transaction fees on the Binance exchange, receive discounts on trading fees, participate in token sales on Binance Launchpad, and purchase goods and services from merchants that accept BNB as payment.

One of the unique features of BNB is that it has a deflationary model. Binance uses a part of its profits each quarter to buy back and burn BNB tokens, reducing the total supply of the token over time. This mechanism is designed to create scarcity and increase the value of BNB over time, with the end goal of reducing the circulating supply of BNB from the initial 200 million to 100 million BNB.

Why BNB?

Binance has burned $450 million worth of BNB tokens, permanently removing over 2.1 million BNB tokens from circulation. This token burn is part of BNB’s auto-burn mechanism, which adjusts the burn amount based on BNB’s price and the number of blocks on the BNB Smart Chain (BSC) during the quarter. The reduction in supply aims to increase BNB’s value for holders and decrease the number of tokens to 100 million (down from 200 million at BNB’s launch).

In addition to the deflationary pressure provided by the token burn, BNB investors will be happy to learn that Binance has recently introduced a new Launhcpool program, Neutron. A smart contract platform built on Cosmos, Neutron aims to make it possible for developers to create decentralized applications that can be deployed on any blockchain that supports the IBC (Inter-Blockchain Communication) protocol without needing to customize their application for each blockchain they want to deploy it on.

The Neutron Launchpool started on October 11 and will remain open until October 30. Users can participate in the farming NTRN farming process with BNB, TUSD, and FDUSD. At the moment, FUSD staking provides an APY of 5.35%, TUSD an APY of 4.26%, and BNB an APY of 4.13%.

9. Optimism

Optimism is a layer-2 scaling solution for the Ethereum blockchain that uses optimistic rollups to increase the speed and lower the cost of transactions on the network.

Optimistic rollups are a type of sidechain that allows for the processing of a large number of transactions off-chain before committing them to the main Ethereum network. This approach significantly reduces transaction fees and speeds up the processing of transactions on the Ethereum network.

Optimism aims to improve the Ethereum ecosystem by reducing the high gas fees associated with transactions, which have been a significant bottleneck for the adoption of decentralized applications (dApps) on the Ethereum blockchain. It does this by enabling faster and cheaper transactions while still maintaining the security and trustlessness of the Ethereum network.

Last year, the Optimism team launched the project’s native token Optimism (OP), a governance token for the Layer 2 network that gives holders participation rights in The Optimism Collective. The Collective is a two-tier governance system composed of the Token House (overseeing technical decisions related to Optimism) and the Citizens’ House (overseeing funding decisions).

Why Optimism?

On Monday, August 28th at 17:00 UTC, the Optimism team is upgrading OP Mainnet enhancements to the “sequencer deployment configuration”. The upgrade is meant to “enable future zero downtime deployments,” according to the team.

According to the status page, OP Mainnet will experience a downtime of about five minutes to accommodate the upgrade.

In addition to the mainnet upgrade, Optimism is participating in Base’s Onchain Summer campaign with Optimism NFT, which dropped on August 24th. Base is an Ethereum layer 2 solution incubated by Coinbase and built on the open-source OP Stack.

Back in June, the Optimism team launched Bedrock, a major upgrade for the Optimism protocol that brought modularity enhancements as well as security and performance improvements.

The OP token, the native digital asset of the Optimism platform, saw considerable growth this year. OP is currently trading at $1.41935, up more than +55% since the start of the year.

10. Shiba Inu

Shiba Inu is a cryptocurrency that was created in August 2020 by an anonymous person or group of people under the pseudonym “Ryoshi”. It is an ERC-20 token on the Ethereum blockchain, which means it is a digital asset that is compatible with the Ethereum network and can be stored in any wallet that supports ERC-20 tokens.

Shiba Inu gained popularity in 2021 after it was listed on several cryptocurrency exchanges and gained attention on social media platforms like Twitter and Reddit. In fact, SHIB’s 2021 run is still one of the most impressive runs in crypto history, as the meme coin gained over 430,000x in a span of the year. It is often compared to Dogecoin, another meme-inspired cryptocurrency, as it features the Shiba Inu dog breed as its mascot.

However, unlike Dogecoin, the project aims to create a decentralized ecosystem for a variety of use cases, including decentralized exchanges, NFTs, and more. The development team has also created a Shiba Inu-themed decentralized exchange called ShibaSwap.

Why Shiba Inu?

After months of waiting, Shibarium went live on the mainnet on August 17th. Shibarium is a layer 2 platform aiming to reduce gas costs for apps in the Shiba Inu ecosystem.

A unique feature of Shibarium is a mechanism wherein SHIB tokens are burned with each transaction. This attribute could bolster the token’s appeal as a long-term investment.

In the week-long period between August 28th and September 3rd, the number of Shibarium wallets surpassed the 1 million milestone, showcasing the community’s immense interest in the newly launched L2 solution.

While the launch of Shibarium didn’t go as smoothly as the team would have hoped for, mostly due to the massive amount of transactions made within minutes of the platform going live, the layer 2 solution could be a massive deal for the meme coin ecosystem going forward. Not only have transactions become cheaper thanks to Shibarium, but the price of SHIB could also be positively impacted by the deflationary pressure provided by token burns.

Since the Shibarium launch, the price of Shiba Inu saw a small downtick in value, decreasing from $0.000007952 on August 17th to $0.000007739 on September 4th.

11. Cosmos

Cosmos is a blockchain project designed to enable the interoperability and scalability of different blockchain networks, dubbed the “Internet of Blockchains”. The native cryptocurrency of the Cosmos network is called ATOM.

Cosmos aims to address some of the key challenges facing the blockchain industry, including the lack of interoperability between different blockchain networks, scalability issues, and the need for greater efficiency in transaction processing.

The Cosmos network achieves interoperability by allowing different blockchains to communicate with each other through a shared hub called the Cosmos Hub, which acts as a central point of communication for different blockchains, enabling them to transfer assets and data between each other.

The Cosmos network also utilizes a PoS consensus mechanism, which allows for greater scalability and energy efficiency compared to PoW consensus mechanisms. Overall, Cosmos aims to create a more interconnected and scalable blockchain ecosystem, and the ATOM cryptocurrency is used to incentivize participation in the network and facilitate transactions.

Why Cosmos?

After the v7 IBC update earlier in the year, a new release for the IBC interface (ibc-go v7.1.0) went live in the first half of June, bringing several improvements to the Inter-Blockchain Communication Protocol, one of the most popular interoperability solutions in the industry.

Introducing: ibc-go v7.1.0 🔭

The Inter-Blockchain Communication Protocol keeps evolving towards creating a wide set of features that improve the UX and pave the way for new interchain applications to emerge.

The latest #IBC release brings exciting new features that strengthen… pic.twitter.com/o8wIDaXUPJ

— Cosmos – Internet of Blockchains ⚛️ (@cosmos) June 9, 2023

Among other things, the v7.1.0 upgrade introduced support for Localhost clients, which improves the overall user experience and allows users to interact with multiple smart contracts on the same chain via a unified interface. According to the Cosmos team, Localhost clients simplify cross-contracts and cross-chain transfers, making it easier to enable “local transfer with consistent guarantees” (which could improve the performance of the Osmosis DEX, for example).

In addition, the upgrade brought the recording total escrowed tokens functionality, allowing users to rate-limit IBC transfers across different chains. This allows users to keep track of the total amount of escrowed tokens between multiple channels and denominations (for example, when transferring value between Juno and Osmosis).

Another exciting development in the Cosmos ecosystem is the upcoming release of Eden v0.50, which will empower the application layer “to have more control over how the consensus engine conducts state machine replication,” and provide “more flexibility and customization options” to dApps. “This upgrade will not only allow Cosmos to compete with the fastest chains but also unlocks new use cases and applications,” the team explained on Twitter.

12. Toncoin

Toncoin is a platform consisting of multiple components. One of its main components is the TON Blockchain (with TON standing for “The Open Network”), which is a flexible multi-blockchain platform capable of processing millions of transactions per second. It supports Turing-complete smart contracts, upgradable blockchain specifications, and multi-cryptocurrency value transfers. The TON Blockchain incorporates unique features such as a self-healing vertical blockchain mechanism and Instant Hypercube Routing, which ensure fast, reliable, scalable, and self-consistent operations.

In addition, the Open Network comprises of the TON P2P Network for accessing the TON Blockchain, TON Storage for distributed file storage, TON Proxy for privacy protection, TON DHT for distributed hash table functionality, TON Services for platform-based services, TON DNS for human-readable naming, and TON Payments for micropayments. TON aims to make blockchain and distributed services more accessible by integrating with popular messaging and social networking apps like Telegram (which already supports TON and BTC transfers).

The native cryptocurrency of the Open Network is Toncoin, which is used to facilitate deposits to become a validator, and cover transaction fees and gas payments (fees incurred from smart contract message processing).

Initially, the Open Network was launched as the Open Telegram Network by the Telegram team but was later rebranded as the community took over the development of the project. Telegram withdrew from development in 2020, after the litigation with the Securities and Exchange Commission (SEC), which accused the company of selling unregistered securities.

Why Toncoin?

A recently released Q3 2023 TON ecosystem report showed very promising on-chain metrics in the Toncoin ecosystem. The number of TON accounts increased by more than +250% in the past year, surpassing 3.5 million accounts.

The large increase in accounts and active wallets could be attributed to a number of positive developments in the TON ecosystem in the past 12 months. In September, TON Foundation partnered with Web3 Data Infrastructure company Chainbase and Chinese technology and gaming conglomerate Tencent. The aim of the partnership is to “simplify blockchain development” for “the next era of Web3 mass adoption across the Asia-Pacific region,” according to the official statement.

The focus on Web3 adoption is nothing new for the Toncoin team. On September 14th, the TON-based wallet integrated with Telegram, one of the more popular messaging platforms. The team dubbed the integration “the largest Web3 onboarding event ever”, providing Web3 features to the 800 million strong user base.

The team’s goal is to onboard 30% of Telegram users by 2028, which would be roughly 500 million people.

“This is undoubtedly the biggest onboarding event in #Web3 to date. With plans to onboard 33x more active Web3 users than ALL chains today. #TelegramFi will be seamless, simple, and give you full control of your digital activity in @telegram,” the team remarked in a thread on the X platform.

The news was very well received by the markets. In the span of just a couple of days since the news broke, the price of TON increased by over +40%. Thanks to the recent price boost, Toncoin surpassed TRON and Solana by market cap and is currently the 9th largest crypto project by market share, commanding an $8.27 billion market capitalization.

Best cryptocurrencies to buy at a glance

| Native Asset | Launched In | Description | Market Cap* | |

| XRP | XRP | 2012 | A leading crypto-powered payment solution | $38.1 bln |

| PancakeSwap | CAKE | 2020 | A popular decentralized trading protocol | $562 mln |

| Bitcoin | BTC | 2009 | A P2P open-source digital currency | $684 bln |

| Solana | SOL | 2020 | One of the fastest and cheapest L1 blockchains | $14.6 bln |

| Chainlink | LINK | 2019 | A decentralized oracle network | $6.3 bln |

| Ethereum | ETH | 2015 | The top blockchain platform for smart contracts | $229 bln |

| Maker | MKR | 2017 | The DeFi protocol behind the Dai stablecoin | $1.3 bln |

| BNB | BNB | 2017 | A decentralized Oracle network | $34.6 bln |

| Optimism | OP | 2022 | A popular Layer 2 scaling solution | $309 mln |

| Shiba Inu | SHIB | 2020 | NFT, DeFi, and blockchain gaming project | $4.7 bln |

| Cosmos | ATOM | 2019 | A leading interoperability-focused blockchain project | $2.8 bln |

| Toncoin | TON | 2018 | A blockchain designed by Telegram and run by the community | $7.2 bln |

Best crypto to buy for beginners

If you are just starting out in crypto, it is advisable to stick to cryptocurrency projects that are less prone to volatility and are generally more established. While this approach does have a downside, as it becomes much more difficult to expect triple-digit or larger gains, the major upside is that you are not exposed to projects that have a chance of failing and, thus, losing your entire investment.

In order to identify projects that are stable and thus feature low volatility, you can start by following the parameters listed below:

- The crypto asset has a market capitalization that places it into the cryptocurrency top 100 (roughly $400 million as of early 2023)

- The crypto asset is available for trading on the best crypto exchange platforms and can be exchanged for fiat currencies

- The crypto asset boasts healthy liquidity ($100M/day and more), which allows you to execute buy and sell orders quickly and without slippage

- The crypto asset is part of a reputable crypto project with clear goals, a realistic roadmap, and products and services that look to address real-world problems

Some of the best cryptos to buy for beginners are those that follow the above criteria and have earned their standing in the crypto market due to robust security, popular products and services, and clear growth potential. Some beginner-friendly crypto investments are:

- Bitcoin

- Ethereum

- Litecoin

- Cardano

- BNB

It is worth noting that cryptocurrency investments are inherently risky, even if you stick to the biggest and most reputable projects. The reason for this is simple – the crypto sector is relatively new, and the landscape might look completely different in the future.

Best crypto for long-term

When deciding which cryptocurrency to buy for the long term, it’s important to consider projects that are well-established, have a strong community, are highly liquid, have a large market cap, and have a clear reason for existing (such as solving a real-life problem, introducing new functionality, etc.). Without these characteristics, a project might fail to survive in the long term, rendering it a bad long-term investment.

It is worth noting that, typically, most long-term crypto investors are looking for projects that have the potential to generate decent returns, but also provide a degree of investment stability. Roughly speaking, only the largest cryptocurrencies fit the bill, as others have a low market cap and liquidity that doesn’t bode well for a long-term commitment (unless you’re prepared to take on more risk).

In addition to Bitcoin and Ethereum, there are a number of other cryptocurrencies that fit the criteria of being low-risk, long-term crypto investments.

If you are planning to hold onto your digital assets for a longer period of time, it is best to take care of crypto custody yourself. Holding large amounts of crypto on an exchange can be risky, as we’ve seen over the years with the collapse of high-profile exchanges like Mt. Gox and FTX. Use one of the reputable crypto hardware wallets to store your crypto. Ledger hardware wallets, for instance, allow you to manage your crypto holdings easily and provide a much higher degree of security than crypto exchanges or even software crypto wallets.

Best place to buy crypto

One crucial aspect to consider when choosing which platform to use to buy crypto is the range of cryptocurrencies and trading pairs available. Since different exchanges support varying digital assets, it’s important to choose a platform that accommodates the specific cryptocurrencies you intend to trade.

Additionally, assessing an exchange’s liquidity and trading volume is essential. Higher liquidity generally results in improved price stability and faster trade executions. Furthermore, it is prudent to examine the fees charged by the exchange, encompassing deposit, withdrawal, and trading fees. Comparing fee structures across different exchanges can help you identify the most cost-effective option that aligns with your trading style. With that said, here are some of the best exchanges on the market right now:

- Binance – The best cryptocurrency exchange overall

- KuCoin – The best exchange for altcoin trading

- Kraken – A centralized exchange with the best security

By diligently considering these factors, you can make an informed decision and select a cryptocurrency exchange that meets your requirements for security, variety, liquidity, and affordability.

How we choose the best cryptocurrencies to buy

At CoinCheckup, we provide real-time prices for over 22,000 cryptocurrencies, with the list growing by dozens each day. As you can imagine, making a selection of a dozen top cryptocurrencies to buy out of such an immense dataset can be difficult and will for sure lead to some projects that should be featured being omitted. To minimize the chance of that happening, we follow certain guidelines when trying to identify the best cryptocurrencies to invest in.

Availability

One of the most important factors for any cryptocurrency investment is the crypto asset’s availability, meaning how easy it is to buy and sell it across various cryptocurrency exchanges. We tend to stay away from assets that are not available on major exchanges and require complex procedures to obtain.

Market Capitalization

Another important metric for identifying whether a crypto project is worth covering its market cap. A high market cap means that the project has reached a certain level of adoption from users, making it less risky to invest in.

Growth Potential

While this metric is mostly subjective, it is still an important metric on which we curate our selection. We won’t feature projects that we think are stagnating or have no real upside in the future.

Purpose and Use Case

We consider the purpose and use case of cryptocurrency, particularly in a real-world setting. Some cryptocurrencies focus on specific industries or applications, such as decentralized finance, gaming, or supply chain management.

Team and Development

The team and people involved in the project can tell you a lot about the potential of a particular cryptocurrency project. We examine the team’s experience, expertise, and track record and evaluate the development activity and updates to ensure the project is actively maintained and evolving.

The bottom line: What crypto to buy now?

The decision of which crypto to buy now is dependent on your own risk profile and investment goals. For some, investing in a crypto asset with a proven track record like Bitcoin is the only type of exposure to crypto they are willing to take on.

Meanwhile, those with a higher risk tolerance might see Bitcoin as too stable, looking instead toward newer and smaller projects that carry a higher degree of upside.

If you are looking for more investment ideas, check out our crypto price predictions section.