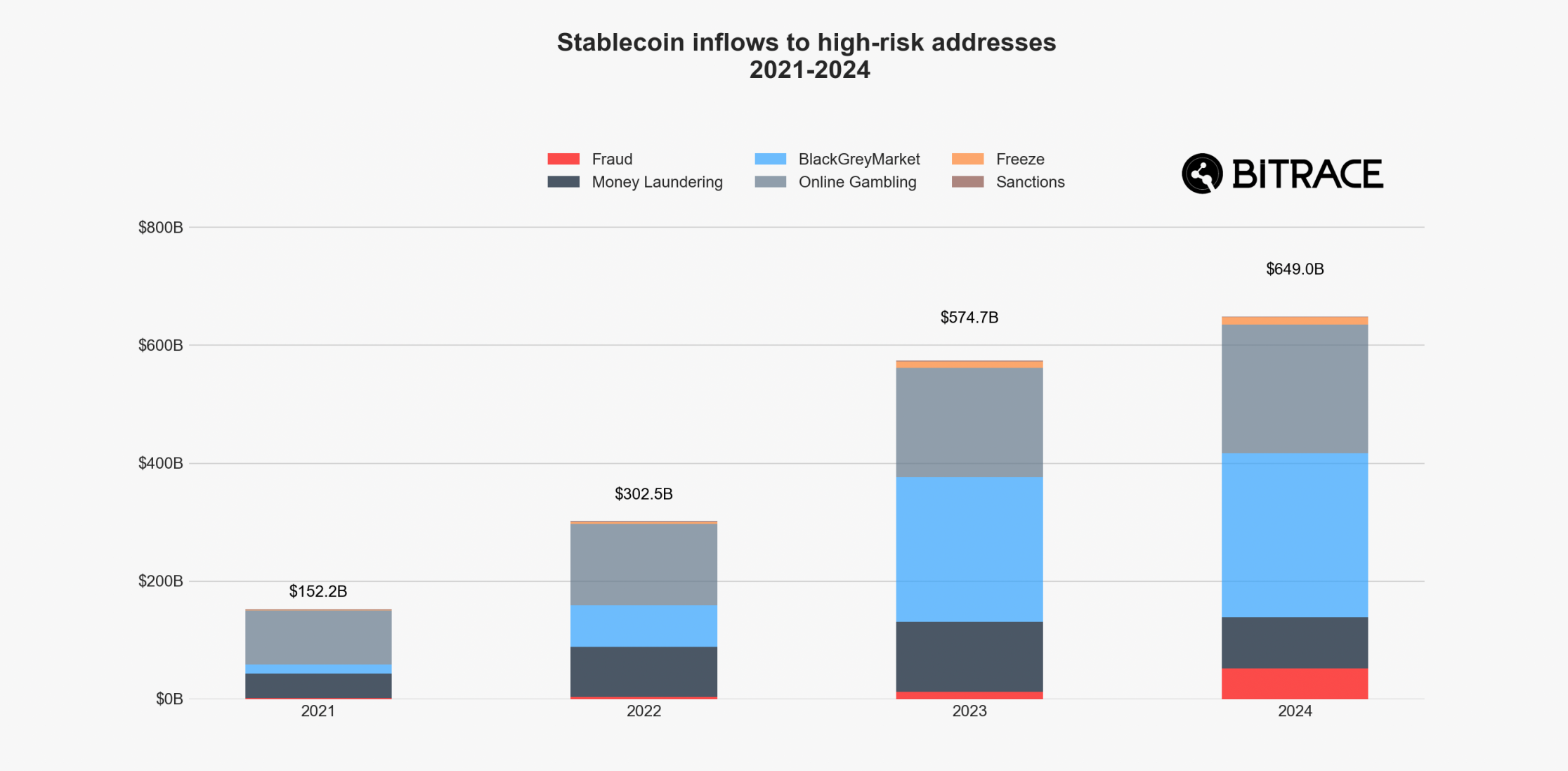

In 2024, criminals transferred over $649 billion in stablecoins to high-risk addresses, according to the Bitrace Crypto Crime Report. The report tracked movements linked to fraud, scams, darknet markets, and crypto gambling.

Although the total dollar value increased compared to 2023, the criminal activity made up only 5.14% of global stablecoin volume. That share is lower than 5.94% in 2023, showing that legitimate stablecoin usage is expanding faster than its role in crypto crime.

The Bitrace report analyzed transactions mainly involving Tether (USDT), the most widely used stablecoin. It found that Tron and Ethereum blockchains hosted nearly all the risky flows. Tron led with more than 75% of stablecoin crime volume, while Ethereum’s share continued to grow.

Tether and Circle Freeze Over $1 Billion in Assets

The report also showed efforts by Tether and Circle to block criminal access to stablecoins. Together, they froze more than $1 billion worth of assets in 2024. That number is twice as much as the last three years combined, according to Bitrace.

Much of the frozen volume came from wallets used in fraud, scam operations, gambling platforms, and escrow services. One case involved Huione, a platform used in cross-border scams. Tether identified and froze multiple wallets tied to the service, but Bitrace said these efforts covered only a small portion of Huione’s transactions.

Circle and Tether acted as private enforcement tools, cutting access to illicit funds directly at the wallet level. These moves form part of a broader pattern as the crypto industry strengthens internal controls.

DeFi and Gambling Sectors Attract Darknet Activity

Bitrace’s data also highlighted changes in how criminals use decentralized finance (DeFi) tools and platforms. As darknet vendors look for ways to hide from law enforcement, many switched to DeFi systems. This shift increased darknet transaction volumes by over $30 billion in 2024.

At the same time, crypto gambling volumes rose by 17.5%, reaching $217.84 billion. Bitrace pointed to weak regulatory systems and easy mobile access as reasons for the rise in gambling-linked activity.

The report also tracked scams and fraud, which jumped from $12 billion in 2023 to $52 billion in 2024. Stablecoins played a central role due to their stable value and fast transfers. Most criminal operations used USDT on Tron for moving funds.

Stablecoins Remain Key Tool in Crypto Crime

Bitrace’s report focused on stablecoins as the main vehicle for crypto crime. The $649 billion total represents both an increase in crime-related transactions and a sign of the sector’s expansion.

The most active blockchain was Tron, used in over three-quarters of the suspicious transfers. Ethereum came second, with its share rising as more users shifted to its network. Other chains played minor roles.

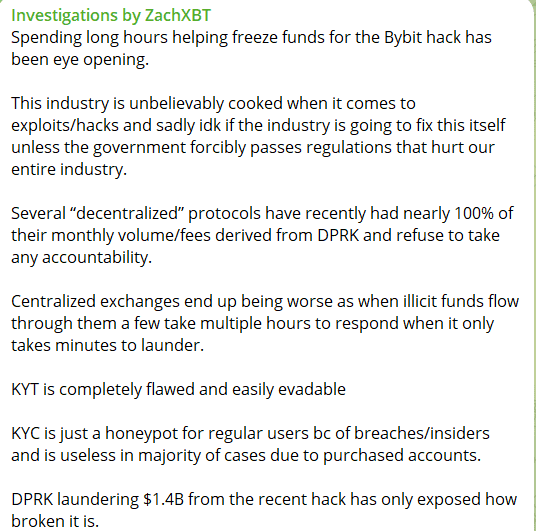

The report also named ZachXBT, a blockchain analyst, who warned in March 2025 that North Korean hacker groups were active in stablecoin-based fraud. He described their involvement as “epidemic” in scale.

Bitrace confirmed that Tether and Circle led enforcement actions by freezing wallets and tracking suspicious movements. Still, it noted that only a small percentage of the total criminal stablecoin volume has been frozen or recovered.

Crime Volumes High, but Share of Market Declines

While the $649 billion in stablecoin crime volume is significant, its market share dropped. In 2024, high-risk activity made up a smaller slice of overall stablecoin transactions.

Bitrace’s report stressed that more enforcement actions were taken last year than in previous years. Yet, the report did not suggest that crypto crime is under control. Instead, it showed that crime activity continues to evolve, especially in areas like DeFi, gambling, and scams.

Stablecoins are central to all of these sectors, making them a focus for both criminal networks and regulators. The report’s data outlines how stablecoins serve as a core payment system in crypto crime but also how enforcement tools like wallet freezing are becoming more common.