You’re looking to make profits in crypto trading, and scalping is one strategy that can help you achieve that goal. Scalp trading is a popular trading approach that involves making a large number of trades in order to leverage small price movements to generate consistent returns. Given the large price volatility of cryptocurrencies, scalp trading can be quite lucrative.

But, to do it successfully, it requires extensive trading knowledge and very solid risk management. And, of course, you need to employ the right strategies. But which strategies work best, and how do you use them effectively? That’s where things get interesting, and that’s what this article will help you with.

The best crypto scalping strategies:

- Range trading

- Using arbitrage

- Bid-ask spread strategy

- Moving average crossover

- Price activity

- Reversal trading

- Stochastic oscillator

What is scalp trading in crypto?

Crypto scalping refers to a short-term trading strategy where traders aim to make small profits by taking advantage of short-term price fluctuations in cryptocurrencies. Scalpers typically execute multiple quick trades within a short period, capitalizing on small price movements.

The goal is to accumulate profits by buying at a lower price and selling at a slightly higher price, often within minutes or even seconds. Crypto scalping requires careful analysis, swift decision-making, and efficient execution to capitalize on small price movements.

How does crypto scalp trading work?

Generally, the best time frame (the duration between the entry and exit) for scalp trades is between 3 and 30 minutes. There are also the so-called 1 min scalping strategy in crypto and the 5 min scalping strategy in crypto, which basically refer to the duration of the chart used to identify a price trend.

Here’s how a crypto scalp trading scenario might play out in practice:

- You study the prices and charts of cryptocurrencies to understand when they might go up or down in value. This helps you decide when to buy or sell.

- When you see a cryptocurrency that you think will go up in price soon, you quickly buy some of it at a lower price.

- Once you own the cryptocurrency, you wait for the price to go up just a little bit, and then you sell it, making a small profit.

- After selling, you repeat the process by looking for another opportunity to buy low and sell high. This can happen many times throughout the day, allowing you to make lots of trades with small profits.

- It’s important to be quick and pay attention to the prices and market trends because they can change fast.

Sounds easy enough, right?

While crypto scalping might sound easy in theory, in practice, it can be very challenging. It requires careful analysis, quick decision-making, and an understanding of the risks involved.

If you’ve never scalp traded before, you should seriously consider using a demo account before using real money – most of the best crypto exchanges give you the ability to trade with demo funds as if they were real money.

The 7 best crypto scalping strategies for making a profit

To be successful in scalp trading, you must have a clear strategy and stick to it. Avoid impulsive and emotional decisions.

Here are seven proven scalp trading strategies that you can start using today.

1. Range trading

One effective strategy for crypto scalping is to zero in on range trading, where you identify key support and resistance levels and capitalize on price fluctuations between these boundaries. If you focus on cryptocurrencies with consistent price patterns.

For example, if you’ve noticed that Bitcoin has been fluctuating between $58,300 and $58,900 for a few days, it might be a good time to employ the range trading strategy. Buy the cryptocurrency when it falls toward the lower bound (the support level) and sell it when it approaches the higher bound (the resistance level). You should repeat the process for as long as the price remains in the price channel you’ve observed.

To increase the effectiveness of range trading, you’ll want to employ technical indicators like RSI or stochastic oscillators to identify overbought or oversold conditions within the defined range.

These indicators will help you establish effective entry points at the support level and exit points near the resistance level. This allows you to make small, incremental gains. Make sure to utilize tight stop losses to protect against unexpected breakouts that could lead to significant losses if the asset breaches established support or resistance levels.

2. Using arbitrage

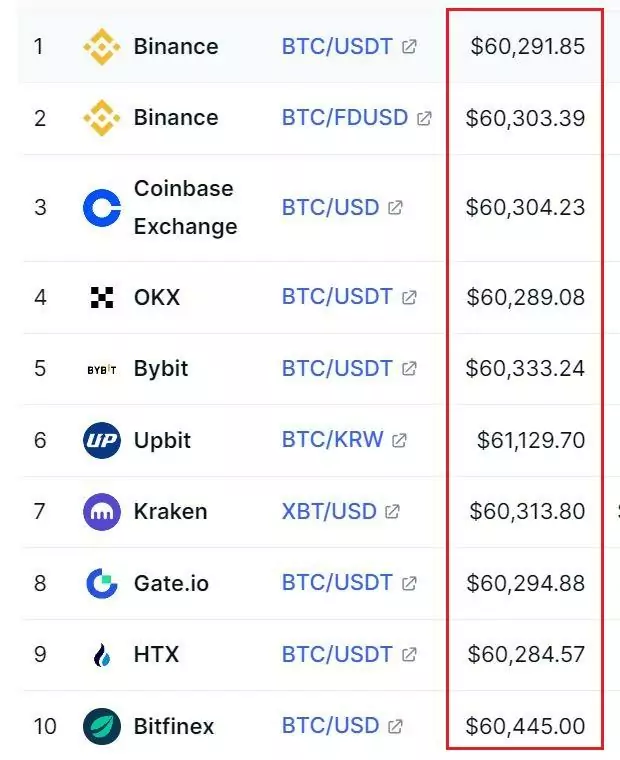

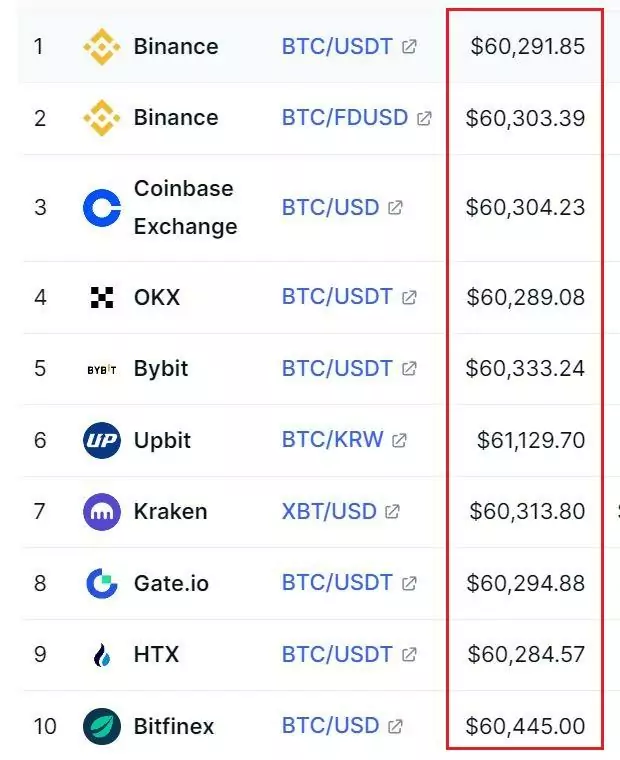

Arbitrage opportunities are plentiful, just waiting to be seized by scalpers with the right strategy and tools. Arbitrage involves exploiting price discrepancies for the same cryptocurrency across different exchanges, i.e. you can buy low on one exchange and immediately sell high on another for profit.

Successful arbitrage requires quick execution, for obvious reasons. It’s great for scalpers who can capitalize on short-lived price differences that may only last for minutes or even seconds. You’ll often need to utilize automated tools or bots to monitor multiple exchanges in real time, as manual detection of arbitrage opportunities can be time-consuming and less efficient.

When implementing this strategy, consider the potential impact of transaction fees, market liquidity, and execution speed on your profits. Common arbitrage opportunities arise during periods of high volatility and trading volume, particularly following significant market events or news announcements. All of these can lead to temporary price differences across exchanges.

3. Bid-ask spread strategy

Another lucrative strategy to explore is the bid-ask spread strategy. This approach capitalizes on the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask).

You’ll look for tight spreads, which indicate good scalping opportunities. To execute this strategy successfully, you’ll need to act quickly, as the spread can fluctuate rapidly.

A narrower bid-ask spread often reflects higher liquidity. This is essential for scalpers to enter and exit positions efficiently. You’ll aim to buy near the bid price and sell close to the ask price, thus maximizing the spread captured.

Leverage high-frequency trades within small price fluctuations. As always, be sure to implement strict risk management techniques, such as tight stop-loss orders, to mitigate potential losses from rapid market movements.

4. Moving average crossover

The moving average crossover strategy is a valuable addition to explore. This strategy utilizes two different moving averages – a short-term moving average (SMA) and a long-term moving average (LMA) – to signal buying and selling opportunities.

Using both the SMA and LMA, you’ll identify momentum shifts that can help you profit from minor price movements.

When the short-term moving average crosses above the long-term one, you’ve got a buy signal. Conversely, when it crosses below, you’ve got a sell signal.

It’s recommended to observe the crossover signals on shorter timeframes, such as 1-minute or 5-minute charts. This will enable you to make quick decisions aligned with rapid fluctuations in cryptocurrency prices.

Combine the moving average crossover with additional technical indicators, like the Relative Strength Index (RSI), so that you can filter out trades that may not be profitable. Remember to factor in transaction fees and slippage, as frequent trades can lead to significant costs.

5. Price activity

The price activity method is based on the underlying factors that influence the price of a crypto asset. Contrary to other strategies, the price action method is similar to buying cryptos without the intention of scalping. The only difference is the short time period you are focusing on when using price action analysis to scalp trade.

There are many different approaches to identifying price trends. Due to the high-speed nature of scalp trading, technical analysis plays the most important role when identifying investment opportunities suitable for scalping.

As there is a significant overlap between scalp trading’s price action strategy and regular investing, you can keep up with the news to find bullish cryptos.

6. Reversal trading

Identifying profitable trades in crypto scalping requires more than just analyzing price activity – you also need to recognize when a trend is about to reverse. This is where reversal trading comes in, a strategy that involves identifying price patterns that indicate potential trend reversals.

If you learn to recognize these patterns, you can capitalize on shifts in market momentum and make profitable trades.

To implement reversal trading effectively, you’ll need to use technical indicators such as the RSI or candlestick patterns. These tools help confirm overbought or oversold conditions.

Also, you’ll need to identify critical support and resistance levels, which serve as key points where price reversals are more likely to occur. To minimize potential losses, set tight stop losses and continuously monitor market news and sentiment. External factors can greatly influence price actions and the likelihood of reversals.

7. Stochastic oscillator

The stochastic oscillator can be a valuable tool for gauging market momentum and timing trades. This momentum indicator compares a cryptocurrency’s closing price to its price range over a specific period. It helps you identify overbought or oversold conditions.

The stochastic oscillator operates within a scale of 0 to 100, where readings above 80 indicate overbought conditions and readings below 20 suggest oversold conditions.

You can use the stochastic oscillator as a key component of your scalping strategy by following these guidelines:

- Buy signals: Look for the %K line to cross above the %D line below the 20 level, indicating a potential buy.

- Sell signals: Look for the %K line to cross below the %D line above the 80 level, indicating a potential sell.

- Confirmation: Combine the stochastic oscillator with other indicators, such as moving averages or volume analysis, to enhance the accuracy of your trades.

- Risk management: Set clear entry and exit points to limit losses and maximize returns.

If all of this sounds alien, you can check out our guide on the main signals to master the crypto market, which involves an explanation of the stochastic oscillator, among six others.

The importance and risks of margin trading

Margin trading allows traders to increase their exposure to markets by entering bigger positions with borrowed funds. This can make scalp trading, which by default involves a very small profit of roughly 1.7% on your investment, or $1.7 if you invested $100 in Bitcoin. However, by using margin to use a 5x leverage, that same price move would generate $8.5, the same profit as if Bitcoin’s spot price increased by 8.5%.

Remember that leverage applies both ways – the losses are amplified just as much as potential profits. In addition, using margin incurs additional charges and fees, which can render breakeven trades unprofitable.

Important factors to consider when crypto scalp trading

To properly execute crypto scalp trading, you need to be decisive, have a strong background in trading, and possess strong risk management skills. In addition, you generally need to follow a broad set of guidelines, carry out our various trading strategies, and do your own analysis – this includes:

- Market analysis: Analyze various market indicators, such as price charts, volume, and order book depth, to identify short-term price movements and potential opportunities for quick profits.

- Setting entry and exit points: Determine specific entry and exit points for their trades based on their analysis. These points are often based on technical indicators, support and resistance levels, or patterns in the price charts.

- Quick trade execution: Enter and exit trades swiftly to take advantage of small price differentials. Use limit orders or market orders to execute trades promptly and avoid missing out on potential profit opportunities.

- Tight stop losses: To manage risk, set tight stop loss orders. These orders automatically close the trade if the price moves against their position by a predetermined amount, limiting potential losses.

- Small profits, large volume: Aim to make small profits on each trade, often just a fraction of a percent, but seek to accumulate profits by executing a high volume of trades throughout the day.

- Leverage: Using leverage can multiply the potential returns (and losses), turning small price swings into highly profitable investment opportunities. Keep in mind that the higher the leverage, the bigger the risks.

- Constant monitoring: Closely monitor the market and your positions, looking for quick opportunities to enter or exit trades. Use advanced trading tools, such as real-time price charts and order book data, to make informed decisions.

The bottom line: Scalping crypto can be profitable if you are disciplined and know what you’re doing

Cryptocurrency scalping requires a great deal of trading knowledge, ranging from technical analysis indicators and fundamental factors to trading charts and other advanced tools. If you don’t know how to interpret price activity and identify market trends, then crypto scalping is not for you.

You’d be much better off investing in crypto for the long term and reaping the potential profits sometime down the line without the constant stress of having to make quick (and correct) decisions.If you want to get involved with cryptocurrency markets but don’t know where to start, check our guide on 12 cryptocurrencies to buy right now.