In the three years since its launch, Uniswap has amassed not only a huge user base but also significant dominance over the Decentralised Exchange (DEX) market. Now with its most recent development, it is heading towards cementing its place in the NFT market as well, one step at a time.

Uniswap Brings NFTs

In a press release on June 21, Uniswap announced the acquisition of the first NFT marketplace aggregator, Genie, which basically lets anyone discover and trade NFTs across most platforms. As Uniswap described this partnership,

“In pursuit of our mission to unlock universal ownership and exchange, today we’re expanding our products to include both ERC-20s and NFTs. NFTs will be integrated into our products, starting with the Uniswap web app, where soon you’ll be able to buy and sell NFTs across all major marketplaces.”

Although this isn’t Uniswap launching its own NFT marketplace as Coinbase did back in May this year. Being an NFT aggregator will allow Uniswap to create one single hub for two of the biggest DeFi offerings – DEX and NFTs – without taking on the complications that come with creating a marketplace.

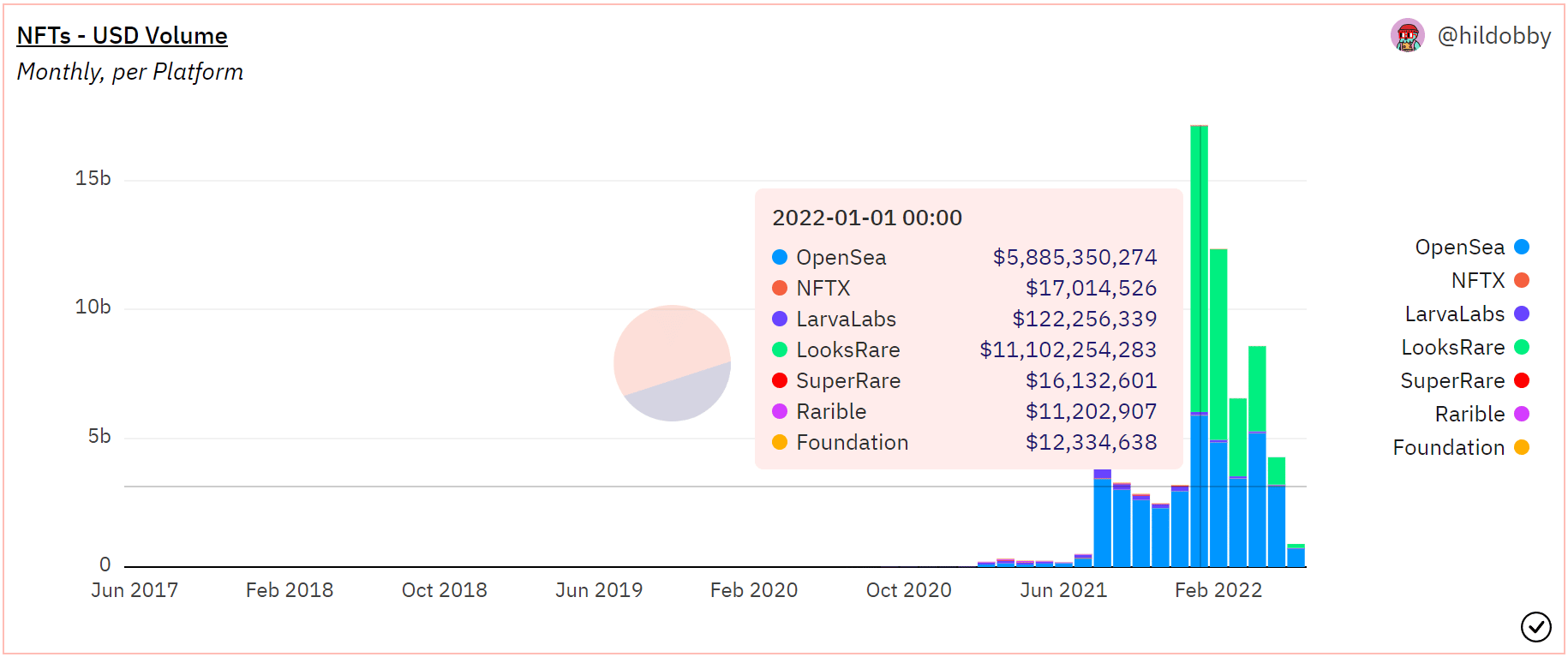

Besides, launching an NFT marketplace in this market is pointless since the existing marketplaces have already built an audience that would be unwilling to shift. The evidence of the same lies with Looksrare, the NFT buying and selling platform that was launched back in January.

For three consecutive months, Looksrare successfully outperformed Opensea to claim the mantle of the biggest NFT marketplace. Monthly volumes for Looksrare in January 2022 touched $11.1 billion, a figure that even Opensea had never reached in a single month.

However, its hype faded as time went on, and with the market turmoil intensifying, both NFT sales as well as Looksrare’s sales, declined.

At the time of writing, Looksrare only managed to conduct NFT sales worth $156 million, whereas Opensea conducted almost 4.4x times higher sales worth $700 million.

Thus, it would be best for Uniswap to stick to its DEX market, where it is already dominating.

Uniswap as a DEX

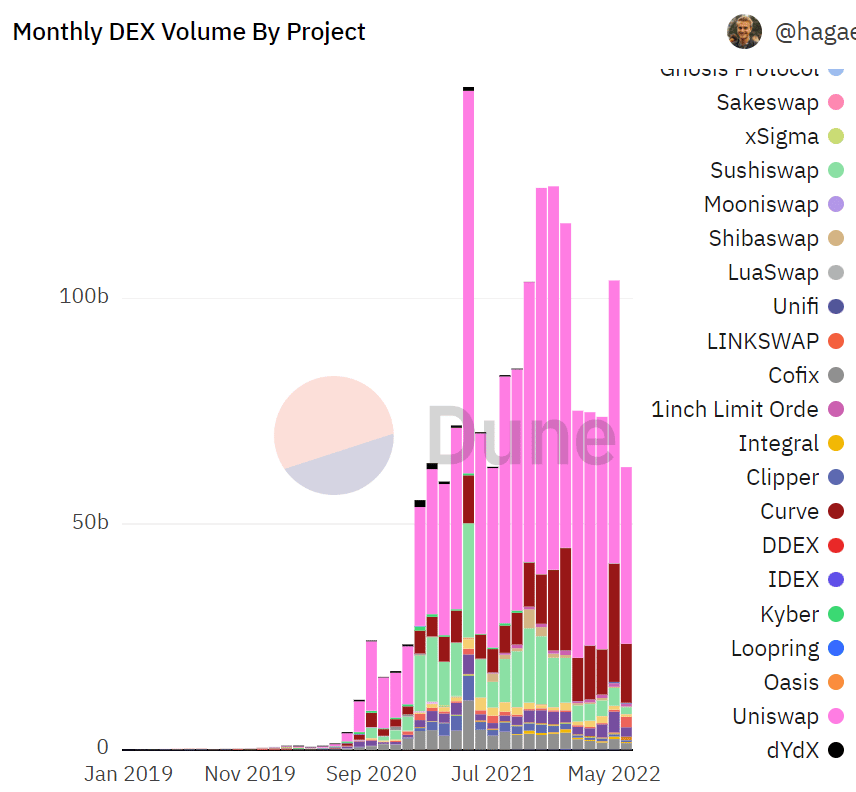

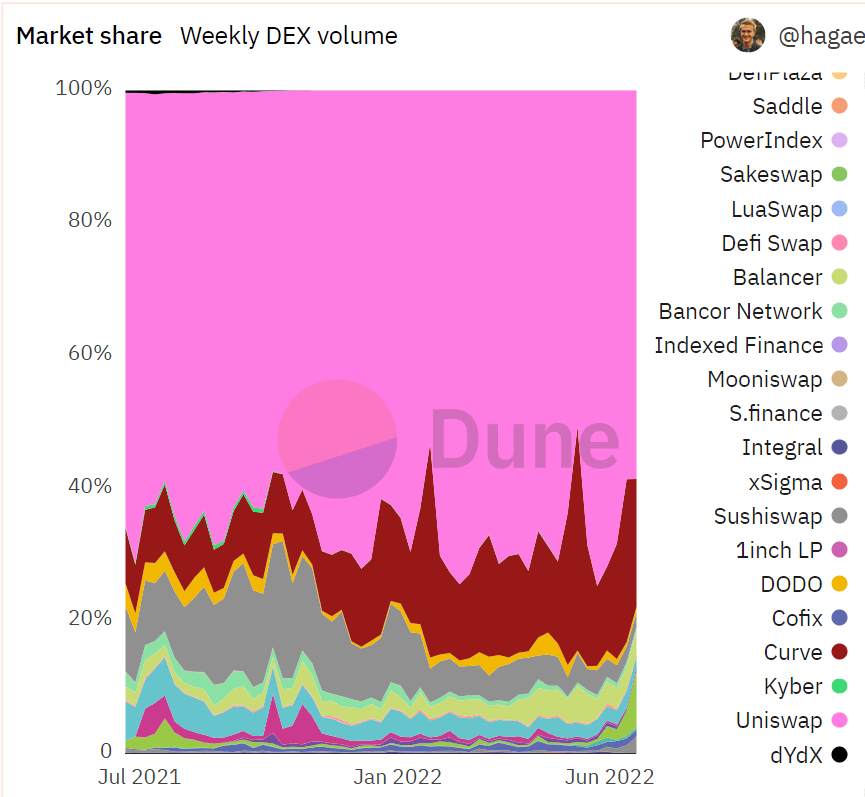

Ever since DeFi caught investors’ and traders’ attention, Decentralised Exchanges have observed growth mirroring the rest of the space. Uniswap being one of the oldest DEX, took over the entire market and currently commands a dominance of at least 50% over the weekly volume generated by DEXes.

In fact, despite the crypto market facing one of its worst crashes in May 2022, Uniswap still managed to draw in trading volume of more than $62 billion.

This month too, during the crash of June 13, when in a week more than $435 billion was wiped out from the crypto market, Uniswap conducted trades amounting to $14.3 billion.

In fact, Uniswap’s domination has been such that its closest competitor, Curve DEX, despite being in the market for more than three years, only contributes a little over 24% to the entire DEX volume every week on average.

Uniswap On The Charts

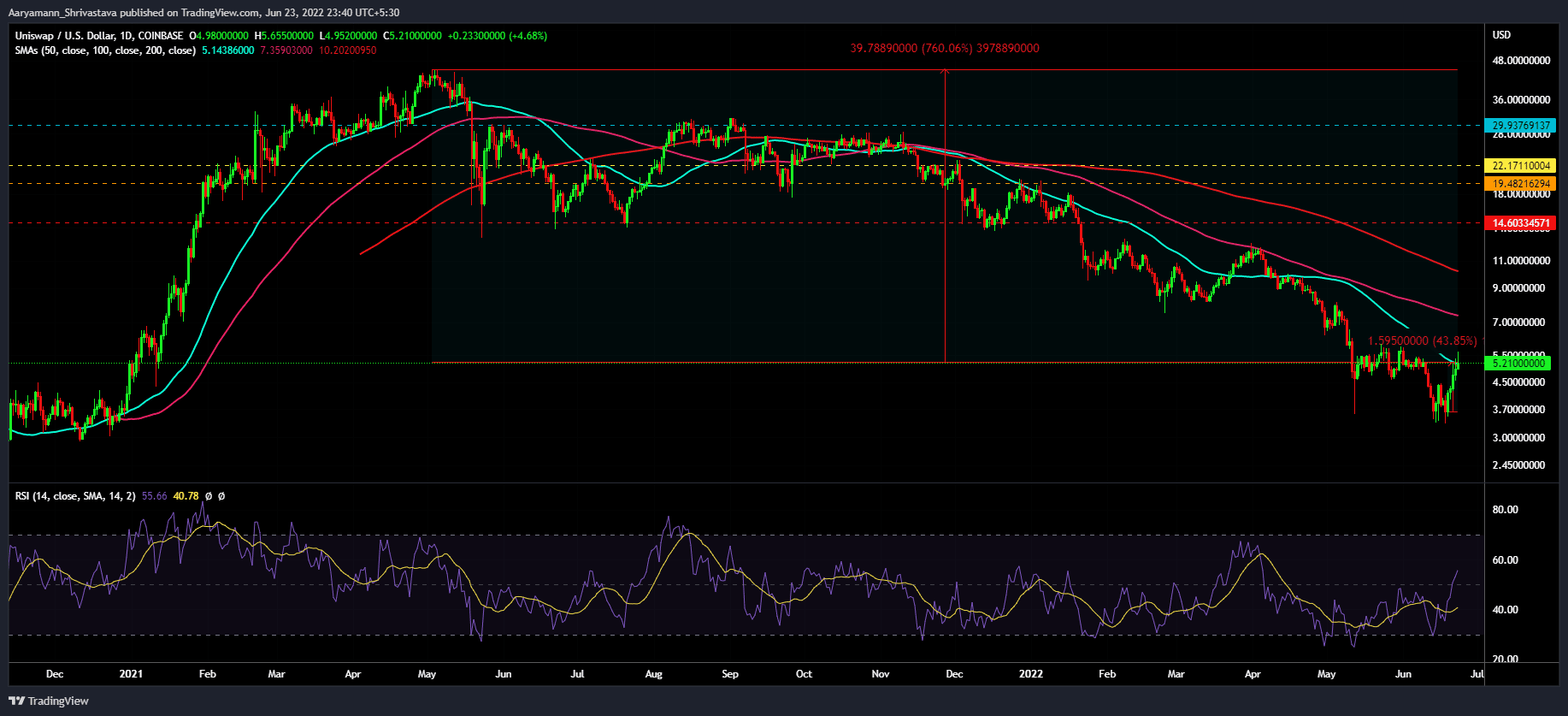

The news of the acquisition certainly triggered a rise for UNI and added to the 43.85% rise of the altcoin invalidating all the losses the DEX token witnessed during this month’s crash.

However so, UNI is still far away from its peak of $45 and trading at $5.2, the altcoin would need to mark a 760% rally in order to mark a new all-time high. This will only be possible when the broader market recovers, which still has some time.