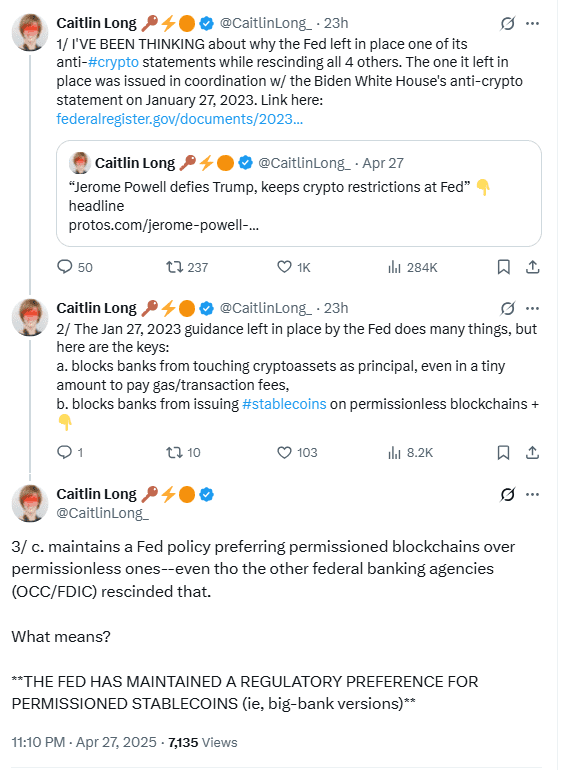

Caitlin Long, Custodia Bank’s CEO, criticized the US Fed over its stablecoin policy favoring big banks. In a post on X dated April 27, Long explained that although the US Fed rescinded four crypto guidelines, it kept one key policy intact.

The unchanged rule, first issued on Jan. 27, 2023, blocks banks from engaging directly with crypto assets. It also prevents them from issuing stablecoins on permissionless blockchains. Long stressed that this preserved policy favors permissioned stablecoins, typically issued by big banks.

“The Fed has maintained a regulatory preference for permissioned stablecoins (i.e., big-bank versions),”

Long wrote. She said this move gives traditional banks a “head start” while the broader crypto market waits for new legislation.

Long’s comments highlighted how the US Fed’s stablecoin policy continues to shape the crypto landscape, particularly benefiting big banks.

US Fed’s Crypto Rules Still Limit Direct Crypto Engagement

While the Fed dropped some older guidelines, the restrictions on stablecoins and direct crypto engagement remain. Caitlin Long pointed out that banks still cannot market-make assets like Bitcoin (BTC $94,206), Ether (ETH $1,776), or Solana (SOL $147.00).

Long added that the US Fed’s crypto rulesprevent banks from covering gas fees for on-chain transactions. Covering these fees is standard practice for crypto custodians but remains restricted for banks.

These limits complicate crypto custody services for banks and slow down their ability to handle digital assets securely. Long described the situation by saying the US Fed kept “sand in the wheels” of banks trying to expand into crypto custody.

By keeping these restrictions, the US Fed ensures that only permissioned stablecoins backed by large institutions move forward easily.

Caitlin Long Exposes Fed’s PR Strategy on Crypto Policy

Caitlin Long further criticized how the US Fed presented its changes. In her X post, she said the Fed listed only the guidance it rescinded and omitted mentioning what it kept.

“The Fed definitely won on PR spin—its press release listed a long list of guidance it rescinded but omitted ANY mention of the guidance it kept. That duped a lot of smart people, understandably,”

Long wrote.

This selective communication, Long argued, made it appear that the US Fed had become more crypto-friendly than it actually had. However, the critical stablecoin policy remained in place, continuing to favor big banks under the surface.

Long’s explanation added new depth to the debate around the Fed’s actual position on digital asset regulation and stablecoin policy.

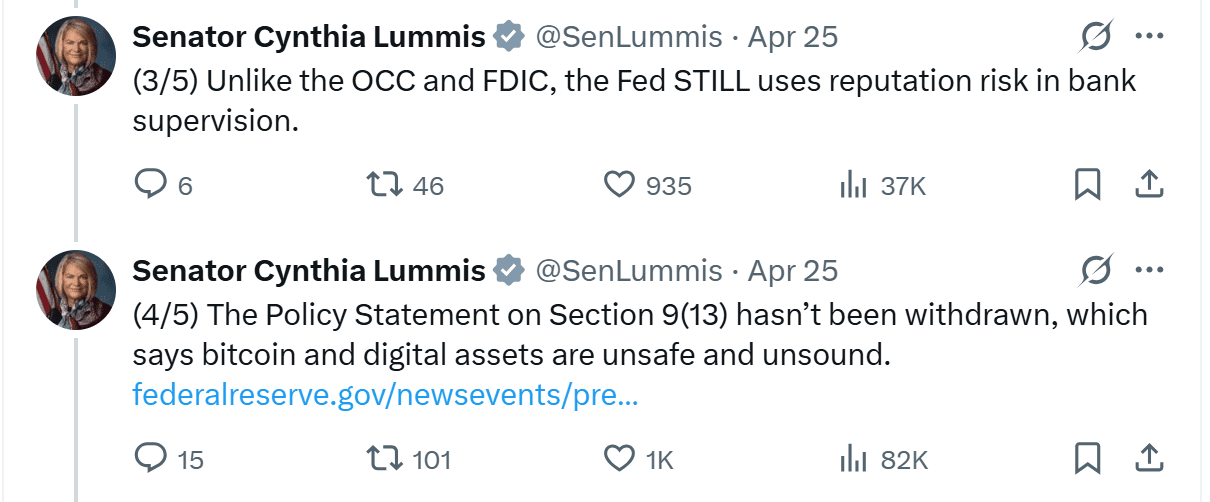

Senator Cynthia Lummis Slams Fed’s Crypto Policy as “Lip Service”

Senator Cynthia Lummis, known for supporting digital assets, also criticized the US Fed’s decision. She called the move “lip service,” indicating that deeper regulatory barriers still exist.

Lummis pointed to Section 9(13) of the Fed’s statement, which categorizes Bitcoin and digital assets as “unsafe and unsound.” This classification remains unchanged, keeping banks restricted from full crypto engagement.

Senator Lummis’ remarks aligned with Caitlin Long’s concerns. She stressed that despite the Fed’s announcement, the fundamental barriers to crypto adoption by banks persist under current policy.

The unchanged language in the US Fed’s crypto rules continues to block banks from broader digital asset activities while favoring stablecoins created by large financial institutions.

Michael Saylor Offers Different View on Fed’s Crypto Shift

Michael Saylor, co-founder of Strategy, responded differently to the Fed’s announcement. In his April 25 post on X, he said the US Fed’s move means “banks are now free to begin supporting Bitcoin.”

Unlike Caitlin Long and Cynthia Lummis, Saylor viewed the rollback as an opening for banks to engage more actively with Bitcoin and the broader crypto market. However, the key stablecoin restrictions highlighted by Long and Lummis remain.

Saylor’s comments show that reactions to the US Fed’s crypto policy shift vary among industry leaders. Some see opportunities, while others continue to focus on the restrictions that slow crypto custody and stablecoin competition.

The broader debate on the US Fed’s stablecoin policy and crypto custody rules continues, with strong attention from both political and industry leaders.