SEC NOIDA (CoinChapter.com) — Celsius (CEL) price has posted sharp gains in recent sessions, defying gravity and logic. While most altcoins have either consolidated or corrected following Bitcoin’s pullback from above $94,000, CEL token surged nearly 70% from last week’s lows.

The rally has left many traders scratching their heads, especially given the backdrop: a collapsed lending platform, an ex-CEO awaiting sentencing, and victims still struggling to recover life-altering losses.

CEL’s price spike appears driven more by volatility and speculative frenzy than any fundamental shift. Given the platform’s bankruptcy and asset restructuring, the token is no longer central to Celsius’s operations, and its recent pump contrasts the project’s grim legal reality.

Retail traders may mistakenly think CEO Alex Mashinsky’s looming sentencing is a potential turning point. However, the facts suggest the opposite. Celsius remains mired in legal and reputational damage. The U.S. Department of Justice has described the case as a “Ponzi-like scheme,” while multiple federal agencies, including the SEC, continue highlighting the company’s unregistered securities offerings.

Court filings reveal how deeply Celsius misled its users. In 2024, the bankrupt estate escalated its pursuit of clawbacks, issuing legal threats to former customers who withdrew over $100,000 within 90 days before the platform’s collapse.

Many of these individuals, who had managed to recover part of their funds before the shutdown, suddenly returned to the crosshairs—this time as legal targets in a bankruptcy process they never saw coming.

With the CEL price pumping amid this mess, the contrast is staggering. A token with no roadmap is suddenly a trending asset. But for many, Celsius is not another crypto project that did not succeed—it’s a scar that refuses to heal.

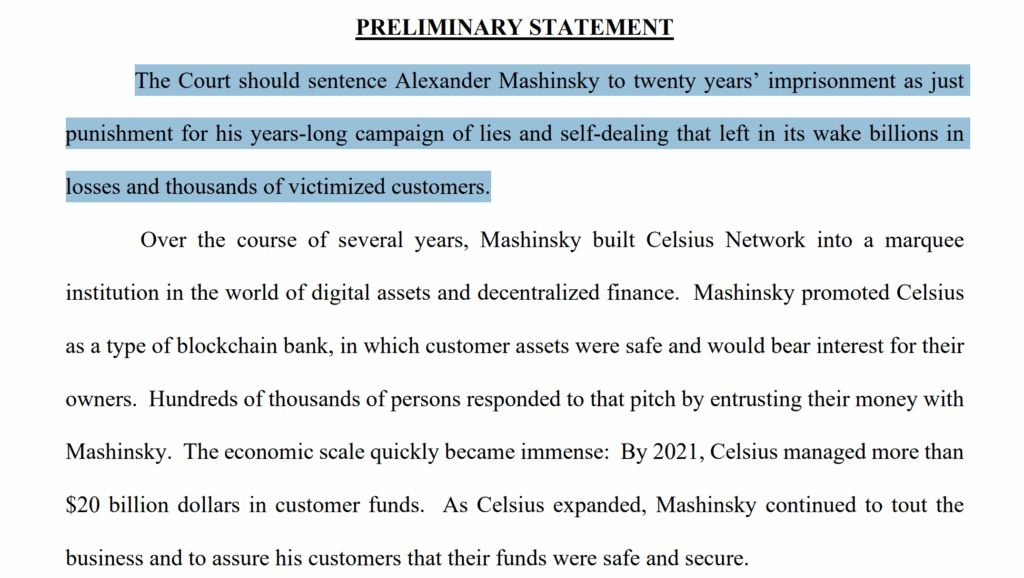

Mashinsky Could Face 20 Years If DOJ Gets Its Way

The U.S. Department of Justice is pushing for a 20-year prison term for Alex Mashinsky, former CEO of Celsius Network, ahead of his May 8 sentencing. Prosecutors argue that Mashinsky orchestrated a calculated, multi-year scheme to mislead investors about the platform’s financial health while manipulating the CEL token’s price. The former Celsius boss pleaded guilty to two felony counts—commodities fraud and market manipulation—in September 2024.

According to DOJ filings, Mashinsky’s tactics included misrepresenting Celsius as a secure, high-yield alternative to banks. In reality, prosecutors say he was masking high-risk loans, inflating token prices through coordinated buys, and presenting a false image of profitability. The platform’s collapse in July 2022 wiped out over $7 billion in customer funds.

More than 200 victim impact statements were submitted to the court. Many describe the devastation in raw terms: life savings gone, marriages strained, mental health deteriorated.

While a tweet shared by Coinfessions last year revealed one user lost 83 ETH, worth over $300,000, the wider community’s pain is similar, if not worse. Users did not see it coming—they unknowingly funded what the DOJ now frames as a Ponzi-like operation.

Some victims are calling for life imprisonment, citing irreparable financial and emotional harm. The DOJ echoes this, stating a 20-year sentence is necessary for deterrence, accountability, and to restore trust in crypto markets. Meanwhile, Mashinsky has agreed to repay $48 million in ill-gotten gains, though prosecutors remain unconvinced it reflects true remorse or restitution.

With sentencing less than two weeks away, the final chapter of Celsius’s downfall is set to unfold—and it could reshape crypto accountability standards for years to come.

CEL Price Rallies Without A Care In The World

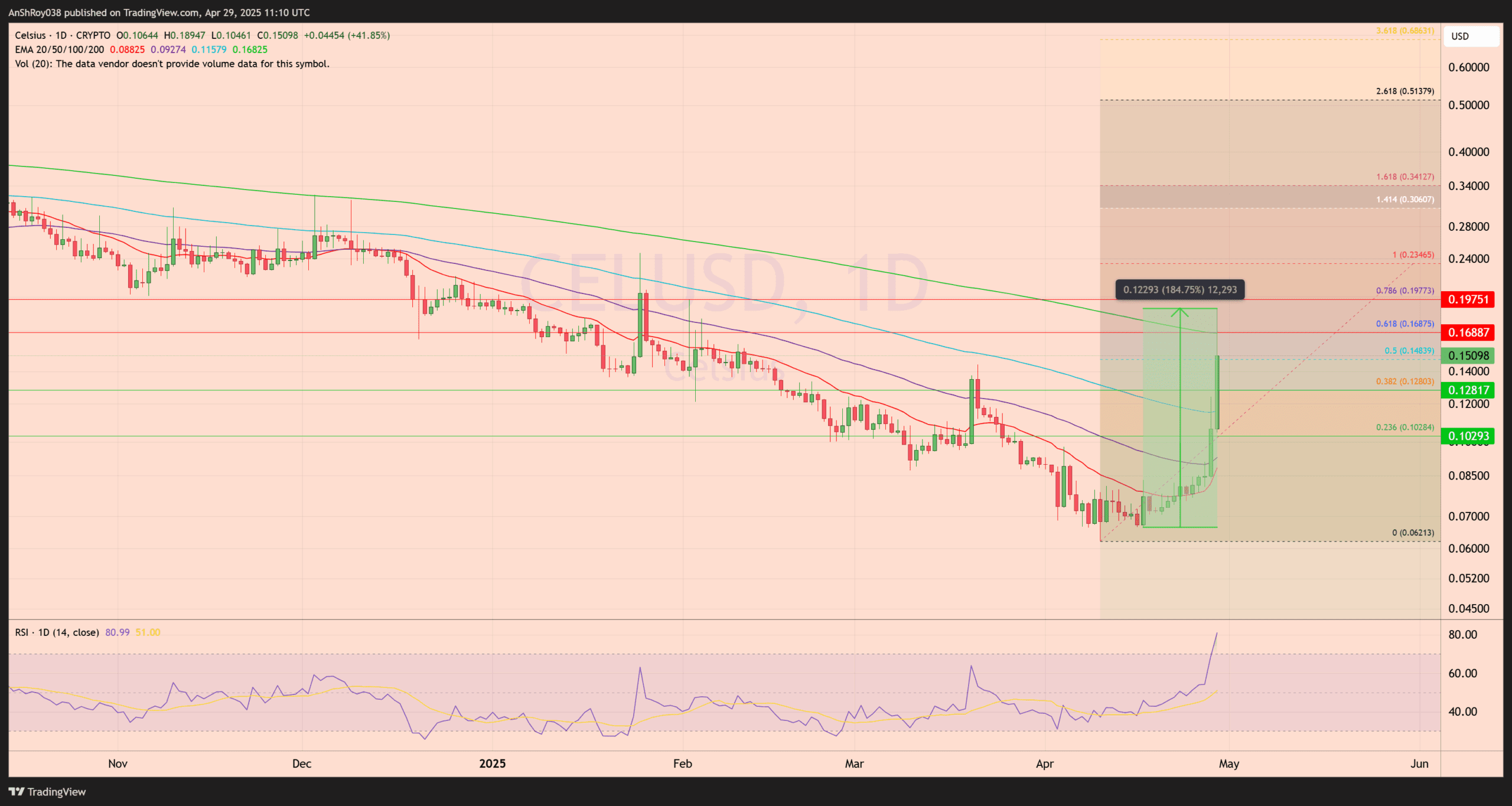

CEL price has exploded upward, tearing through technical levels with reckless abandon, completely detached from the crumbling project it represents. While Alex Mashinsky prepares to hear his fate in federal court, the token bearing Celsius Network’s name acts like it has just discovered a second life.

On Apr. 29, CEL rallied as high as $0.189, a 184% surge from April 17’s low near $0.06. It pierced multiple resistance levels in the process. Price cleared the 0.236 Fib retracement at $0.102, broke through the $0.128 zone near the 0.382 Fib, and then overtook the $0.143 area aligned with the 0.5 retracement.

The Celsius token price now faces immediate resistance near $0.168, which coincides with the 0.618 Fib and matches the 200-day EMA. Flipping that level would open the door toward $0.197, the 0.786 Fib zone and Oct. 2024 high rejection range.

On the downside, CEL has initial support near $0.143. Below that, the $0.128 and $0.102 zones act as layered buffers from this month’s accumulation breakout. The RSI sits at 81, flashing overbought signals and suggesting exhaustion may follow.

Yet none of this aligns with reality. Celsius has no roadmap, no team revival, and no utility left. But the price moves like none of that matters—as if CEL bulls have amnesia. The token has decoupled from its disgrace, pumping like Mashinsky’s sentencing is just background noise.