Coinbase will launch the Coinbase Bitcoin Yield Fund on May 1, aiming to offer 4% to 8% annual returns for institutional investors holding Bitcoin. The exchange, ranked as the world’s third-largest by trading volume, confirmed the details through an official blog post dated April 28.

The Coinbase Bitcoin Yield Fund targets institutional investors outside the United States who seek Bitcoin passive income without selling their assets. According to Coinbase, the fund addresses rising demand among institutions for low-risk Bitcoin yield solutions.

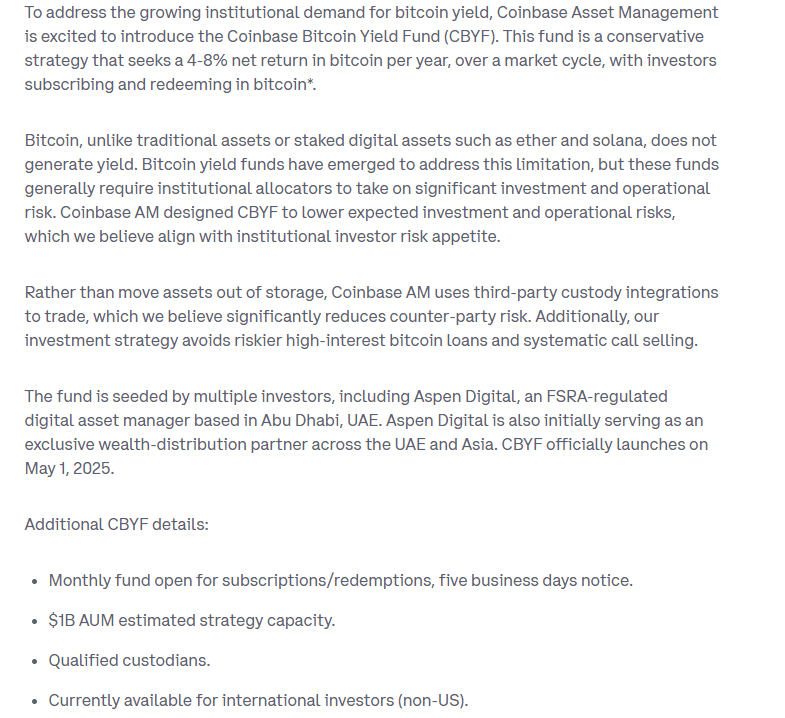

“To address the growing institutional demand for bitcoin yield, Coinbase Asset Management is excited to introduce the Coinbase Bitcoin Yield Fund (CBYF),”

the blog post stated.

Coinbase Bitcoin Yield Fund Will Use Cash-and-Carry Strategy

The Coinbase Bitcoin Yield Fund plans to generate Bitcoin passive income using a cash-and-carry strategy. This strategy profits from the difference between spot Bitcoin prices and derivatives contracts, without selling Bitcoin.

Bitcoin holders, unlike holders of Ethereum (ETH) or Solana (SOL), cannot earn staking rewards. Coinbase noted that Bitcoin yield products aim to fill this gap but often expose investors to significant investment and operational risks.

According to the announcement, the Coinbase Bitcoin Yield Fund seeks to reduce those risks. By doing so, Coinbase aims to align the product with the risk management requirements of institutional investors.

Aspen Digital Among Backers of the Coinbase Bitcoin Yield Fund

Coinbase also revealed that Aspen Digital, a digital asset manager based in Abu Dhabi and regulated by the Financial Services Regulatory Authority, is one of the main investors supporting the Coinbase Bitcoin Yield Fund.

This backing demonstrates institutional involvement in the new fund, giving it additional credibility in the international market. Coinbase highlighted that CBYF differs from other Bitcoin passive income options because it prioritizes lower operational risks and higher compliance standards.

The collaboration with Aspen Digital underlines Coinbase’s focus on building secure structures for institutional investors who want Bitcoin exposure through regulated pathways.

Institutional Interest Drives Bitcoin Price and Bitcoin ETF Inflows

Coinbase cited rising institutional crypto adoption as a key reason behind launching the Coinbase Bitcoin Yield Fund. Growing interest from institutions has coincided with notable movements in the Bitcoin price.

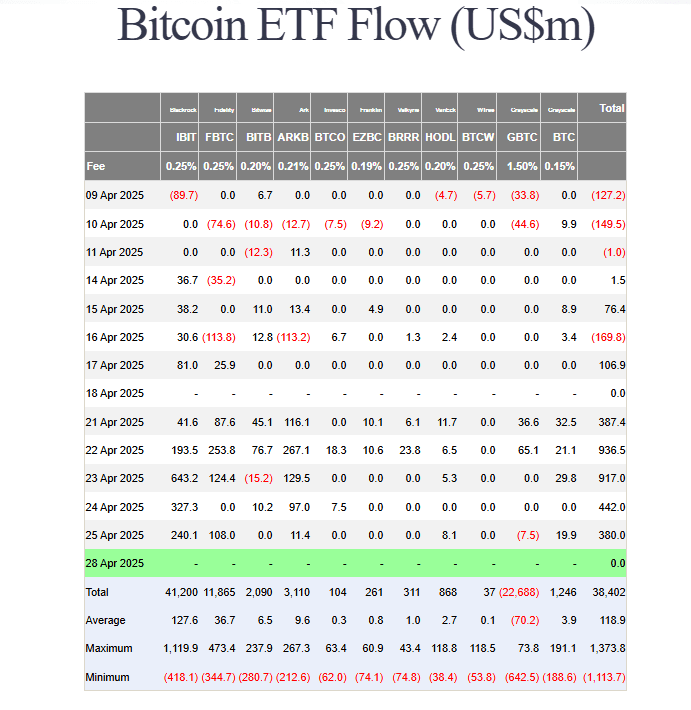

Data from Farside Investors showed that Bitcoin ETF inflows exceeded $3 billion in the week leading up to April 28, marking the second-highest weekly inflow figure. Bitcoin price rose by over 9%, reaching around $94,000 during the same period.

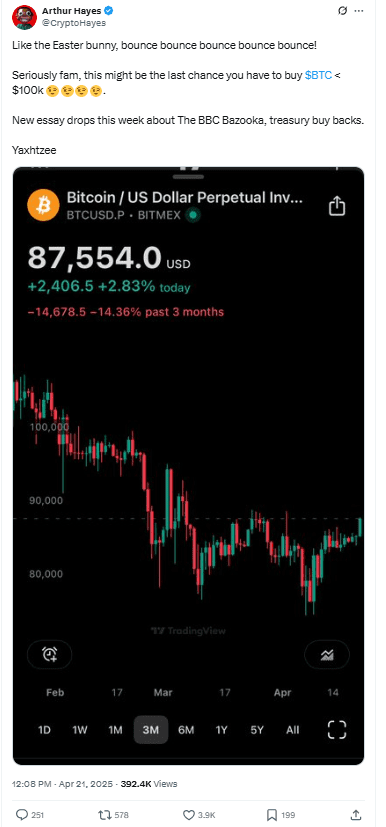

On April 21, Arthur Hayes, co-founder of BitMEX, commented that Bitcoin’s current price levels might offer a “last chance” to acquire Bitcoin below $100,000. Hayes referenced the upcoming U.S. Treasury buybacks as a factor that could impact Bitcoin price momentum.

These remarks align with broader observations that the Bitcoin price recovery is mainly linked to institutional investors and Bitcoin ETF inflows rather than retail activity.