Here are the latest updates on the U.S. President Donald Trump’s ongoing tariffs policy.

April 28, 2025: China Remains Confident on 2025 Growth Despite U.S. Tariffs

Chinese officials on Monday tried to calm fears that heavy U.S. tariffs could derail China’s economic recovery. Analysts have warned that the ongoing trade war between the U.S. and China could badly hurt growth by disrupting supply chains and affecting many industries.

However, Zhao Chenxin, the vice head of China’s National Development and Reform Commission (NDRC), said he was \”fully confident\” that China would still meet its economic growth target of around 5% for 2025.

Speaking at a press conference, Zhao said that China’s strong first-quarter results had built a solid foundation for the rest of the year. He added that new support policies could be introduced in the second quarter if needed, depending on how the economy performs.

Zhao also emphasized that China would stay focused on its own development plans, regardless of how the international situation changes.

April 25, 2025: China Demands Full Tariff Removal Before Trade Talks Begin

China has told the United States that if President Donald Trump is serious about ending the trade war, he must first cancel all U.S. tariffs on Chinese goods. Chinese officials said there have been no formal trade talks between the two countries, even though Trump claimed that discussions had taken place.

Earlier this week, Trump said the U.S. and China had held meetings and were negotiating. He also suggested that the 145% tariff on Chinese imports could be “substantially” reduced, though not eliminated entirely. That statement helped lift market sentiment and gave investors hope that tensions might ease.

But China quickly pushed back. A spokesperson for the Chinese commerce ministry said there are currently no trade negotiations between the two countries. Later, at a foreign ministry press briefing, another official called reports of trade progress “baseless rumours.” He said if the U.S. wants peace, it must “completely cancel all unilateral tariff measures.”

China Sends Boeing Planes Back as Retaliation

In one of its strongest responses yet, China sent back Boeing planes it had previously ordered from the U.S. This marks another direct blow in the ongoing tariff battle and a sign that relations remain tense.

Earlier this month, China also responded to U.S. tariffs with a 125% tariff on American goods. U.S. Treasury Secretary Scott Bessent has said the current situation is unsustainable and compared it to a trade embargo.

IMF Calls for Immediate Trade Truce

The International Monetary Fund (IMF) has joined the calls for an end to the trade war. IMF Director Kristalina Georgieva said that global economic uncertainty has “spiked off the charts” due to the conflict. Speaking at a press conference in Washington, she said a quick resolution is necessary to avoid further damage to the global economy.

Georgieva warned that uncertainty is stopping businesses from investing and leading households to save instead of spend. This, she said, is making already weak economic growth even worse.

She did not criticize the U.S. directly but said the world’s major economies must settle their trade differences quickly to restore confidence.

April 24, 2025: 12 U.S. States Sue Trump Over Tariffs; Trump Says China Relief Depends on Negotiations

A coalition of 12 U.S. states has filed a lawsuit in the U.S. Court of International Trade, challenging President Donald Trump’s tariff policy. The states argue that Trump has overstepped his authority by using emergency powers to impose broad trade tariffs without approval from Congress. The lawsuit accuses the president of misusing the 1977 International Emergency Economic Powers Act (IEEPA), which is only meant for real emergencies, not regular trade actions.

The lawsuit says Trump’s actions have disrupted the U.S. economy and upset the balance of power between the executive branch and Congress. The 12 states—Oregon, Arizona, Colorado, Connecticut, Delaware, Illinois, Maine, Minnesota, Nevada, New Mexico, New York, and Vermont—are asking the court to declare the tariffs unlawful and prevent federal agencies from enforcing them.

Meanwhile, President Trump spoke to reporters at the White House and said he may lower the 145% tariff on Chinese goods, but only if Beijing agrees to new trade terms. Trump said the U.S. had been “ripped off for years” and would only reduce tariffs as part of a fair deal.

He also mentioned that more tariff changes could come in the next few weeks, depending on negotiations. Trump said he continues to have a good relationship with Chinese President Xi Jinping and still hopes a deal can be reached. But he added, “If we don’t have a deal… we’re going to set the tariff.”

April 14, 2025: Trump Denies Tariff Exemptions, Says No Country Is \”Off the Hook\”

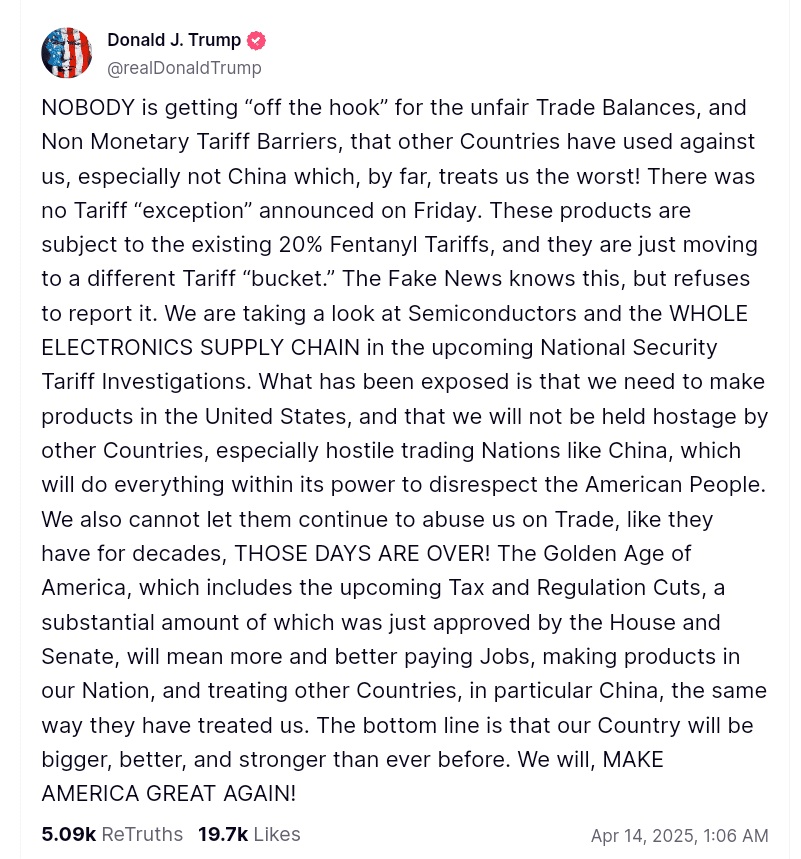

President Donald Trump denied that any country would be exempt from his tariff program, pushing back against reports of trade relief for tech products. His remarks followed a U.S. Customs and Border Protection guidance issued on April 11, which appeared to exempt smartphones, computers, and other electronics from the new tariffs.

In a Truth Social post, Trump wrote, “NOBODY is getting ‘off the hook’ for the unfair Trade Balances… especially not China which, by far, treats us the worst!” He added that there was no official tariff exemption and claimed that these products remain subject to the existing 20% fentanyl-linked tariffs, though they may now fall under a different tariff classification.

Trump also accused the media of misreporting the situation, saying, “The Fake News knows this, but refuses to report it.”

Later, speaking to reporters on April 13, Trump clarified that any relief for electronics from China was temporary. He added that his administration is still reviewing tariffs on semiconductors, and said an official announcement would be made soon.

April 11, 2025: U.S. Raises China Tariffs to 145%, China Targets Hollywood, Markets Slide

The White House confirmed on April 10 that the total U.S. tariff rate on Chinese imports has reached 145%, after adding together past and recent levies. This includes a 20% duty imposed earlier this year, a 34% tariff introduced last week, and a new 91% increase applied this week. The White House clarified the updated figure after President Trump incorrectly cited 125% on Truth Social.

In response, China’s National Film Administration announced it would reduce the number of Hollywood films released in its domestic market. The agency linked this decision directly to the new U.S. tariff hike, calling it a defensive move in the ongoing trade war.

Asian markets fell sharply today on April 11 following the White House’s clarification. Japan’s Nikkei 225 lost nearly 4%, and China’s CSI 300 dropped 1.2%. Hong Kong’s Hang Seng index fell 3.1%, while MSCI’s Asia-Pacific index outside Japan slid 1.7%.

Trump is also facing accusations of market manipulation. On Wednesday morning, he posted “THIS IS A GREAT TIME TO BUY!!! DJT” on Truth Social. Hours later, he announced the 90-day tariff pause for most countries, triggering a historic stock market rally. Critics now question the timing of his message.

April 10, 2025: Trump Pauses Tariffs for Most Countries, But Increases Them on China

U.S. President Donald Trump announced a 90-day pause on tariffs for most U.S. trading partners. This means that countries other than China will not face new U.S. tariffs for the next three months. Trump made the announcement on April 9, just one day after new tariffs were put in place. While most countries got a break, China did not. Instead, Trump increased the tariff on all Chinese goods to 125%. This rate is higher than any previous tariff during his presidency. Trump said China had refused to back down and remove its own tariffs on U.S. products. So, the U.S. was raising pressure. At the same time, the White House warned other countries not to retaliate. A statement from the administration said: “Do not retaliate and you will be rewarded.”

China Responds With More Tariffs

China did not accept Trump’s demands. Within hours of the U.S. announcement, China responded. It imposed a new 84% tariff on all American imports. These new Chinese tariffs took effect today on April 10. Following the tariff pause news, U.S. stock markets had one of their strongest days on April 10. The S&P 500 rose by 9.5%, which is a gain normally seen over an entire year.

The Nasdaq Composite jumped 12%, gaining more than 1,857 points to reach 17,124.97. The Dow Jones Industrial Average climbed 7.9%, ending a stretch of market losses caused by tariff fears.

April 9, 2025: U.S. Hits China with 104% Tariff

The United States officially imposed a massive 104% tariff on Chinese imports on April 9. The move follows President Donald Trump’s ultimatum to China earlier this week, where he warned of steep new duties if Beijing refused to roll back its 34% counter-tariff on American goods. China did not comply, prompting the White House to proceed with its tariff escalation. The new 104% tariff is the result of three cumulative increases:

- A 20% tariff announced in March.

- A 34% tariff implemented as part of the “Liberation Day” policy.

- An additional 50% penalty was confirmed this week.

Following the announcement, the Asian stock market tumbled. On April 9, Japan’s Nikkei 225 index dropped nearly 4%. Markets in South Korea, New Zealand, and Australia also posted losses over the deepening U.S.-China trade war. China’s major stock indexes fell in response. The CSI 300, which tracks China’s top blue-chip stocks, slipped 1.2%, while Hong Kong’s Hang Seng index plunged 3.1%.

April 8, 2025: Trump Threatens China with 50% Tariff; Markets Swing Wildly

Tensions between the United States and China escalated further on April 8 after President Donald Trump threatened to impose an additional 50% tariff on Chinese goods. The warning came in response to China’s decision to retaliate against Trump’s earlier 34% tariff by placing a similar counter-tariff on American imports. President Trump gave China a 24-hour deadline to remove its 34% countermeasure. He said that if China refused to back down, the United States would respond with a 50% import tariff on all Chinese goods. The Chinese embassy in Washington quickly responded by accusing the U.S. of “economic bullying.” It also stated that Beijing would “firmly safeguard its legitimate rights and interests.” The growing uncertainty over trade policy led to volatile movements across financial markets throughout the day. Stock futures initially rose in after-hours trading late Monday. Contracts tied to the Dow Jones Industrial Average, the S&P 500, and the Nasdaq-100 all gained more than 1%.

April 7, 2025: China Plans Stimulus as Global Markets Struggle; Trump Dismisses Recession Fears

Chinese leaders held emergency meetings over the weekend to discuss how to respond to President Trump\’s growing list of tariffs. According to people familiar with the matter, top Chinese policymakers and financial regulators considered fast-tracking stimulus plans to help stabilize the economy and boost domestic consumption.

Some of these stimulus measures were already in development before the U.S. tariffs but may now be accelerated to counter the economic shock. No final decisions have been announced publicly.

Trump Dismisses Market Concerns, Demands Trade Deficit Elimination

President Trump, speaking aboard Air Force One on Sunday, pushed back against fears that the tariffs would lead to inflation or a recession. He insisted that the market volatility was only temporary and claimed the U.S. would enter a new economic “boom.”

Trump also made it clear that he would not lower the highest tariffs unless the U.S. completely eliminated its trade deficit with specific countries.

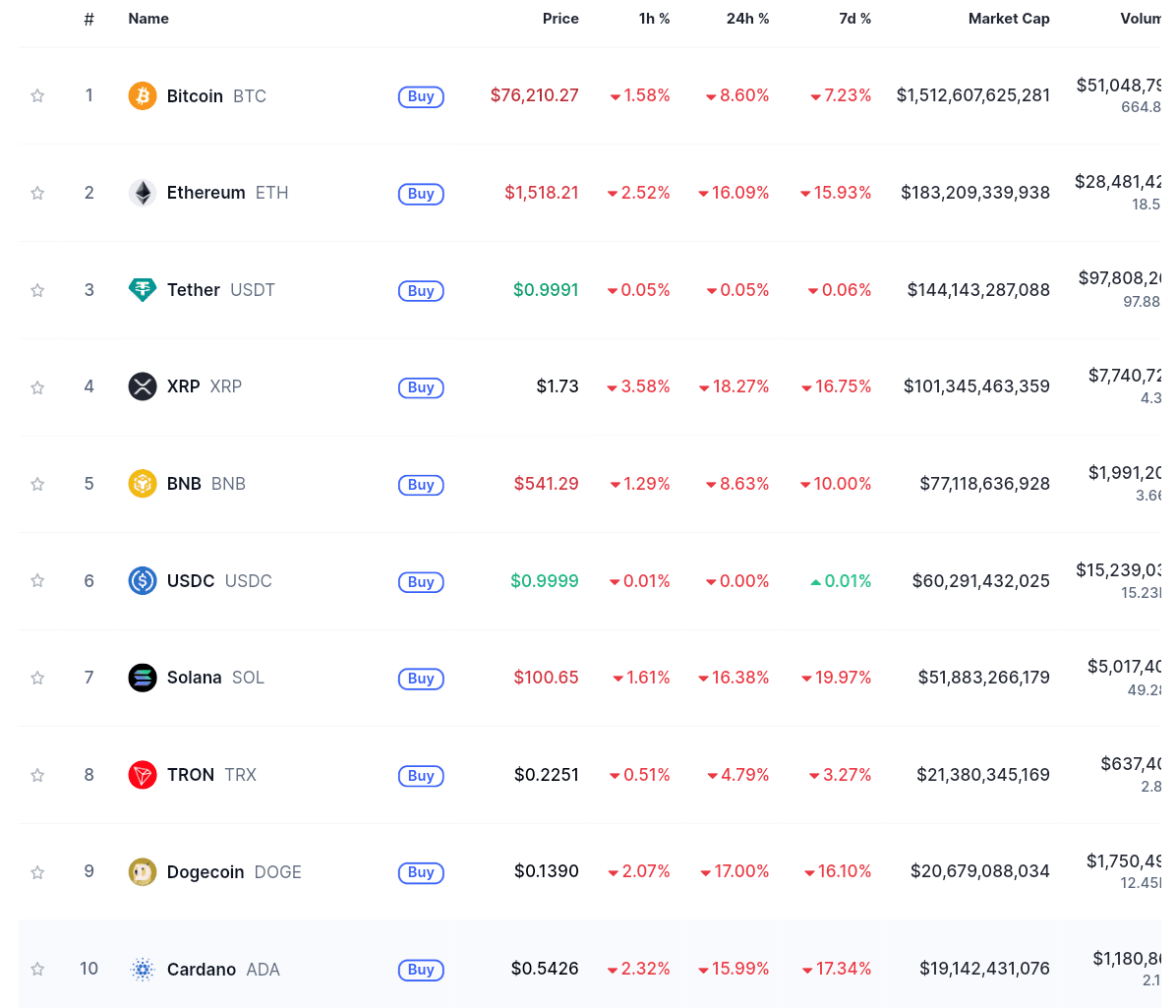

Crypto and Stock Futures Drop Again

The global financial fallout continued as U.S. stock futures opened lower and cryptocurrencies saw another sharp drop. Today, all top 10 Cryptocurrencies by market cap are down. Bitcoin lost over 8% of its value, falling to around $76,210. Ether declined more than 16%, trading at $1,518. The total crypto market capitalization dropped over 8%, hitting $2.5 trillion.

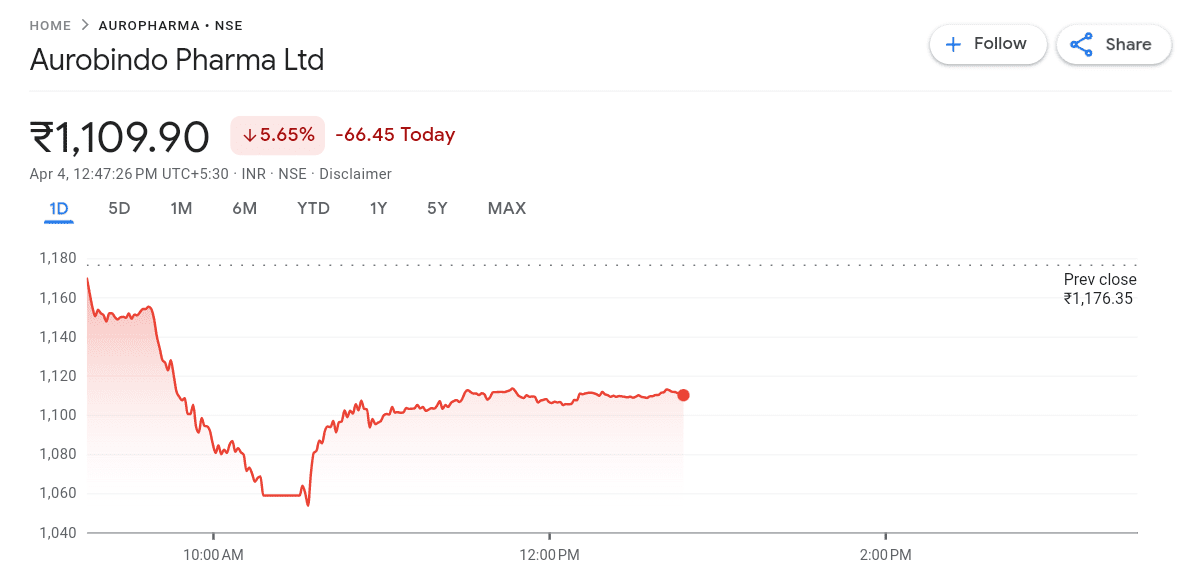

April 4, 2025: Trump Revises Tariffs, India Targeted; Pharma Stocks Crash

A new White House document released on April 4 shows that Trump’s tariff rates have been revised for at least 14 countries, including India. India’s tariff rate was first mentioned by Trump as 26%, but the new annex initially listed it at 27%. The final document confirms it has been revised back down to 26%.

Trump’s administration also announced that pharmaceuticals and semiconductors are now under review for possible new tariffs under Section 232 of the Trade Expansion Act of 1962. This section allows the U.S. President to impose tariffs if imports are seen as a threat to national security.

Following this news, Indian pharmaceutical stocks took a hard hit:

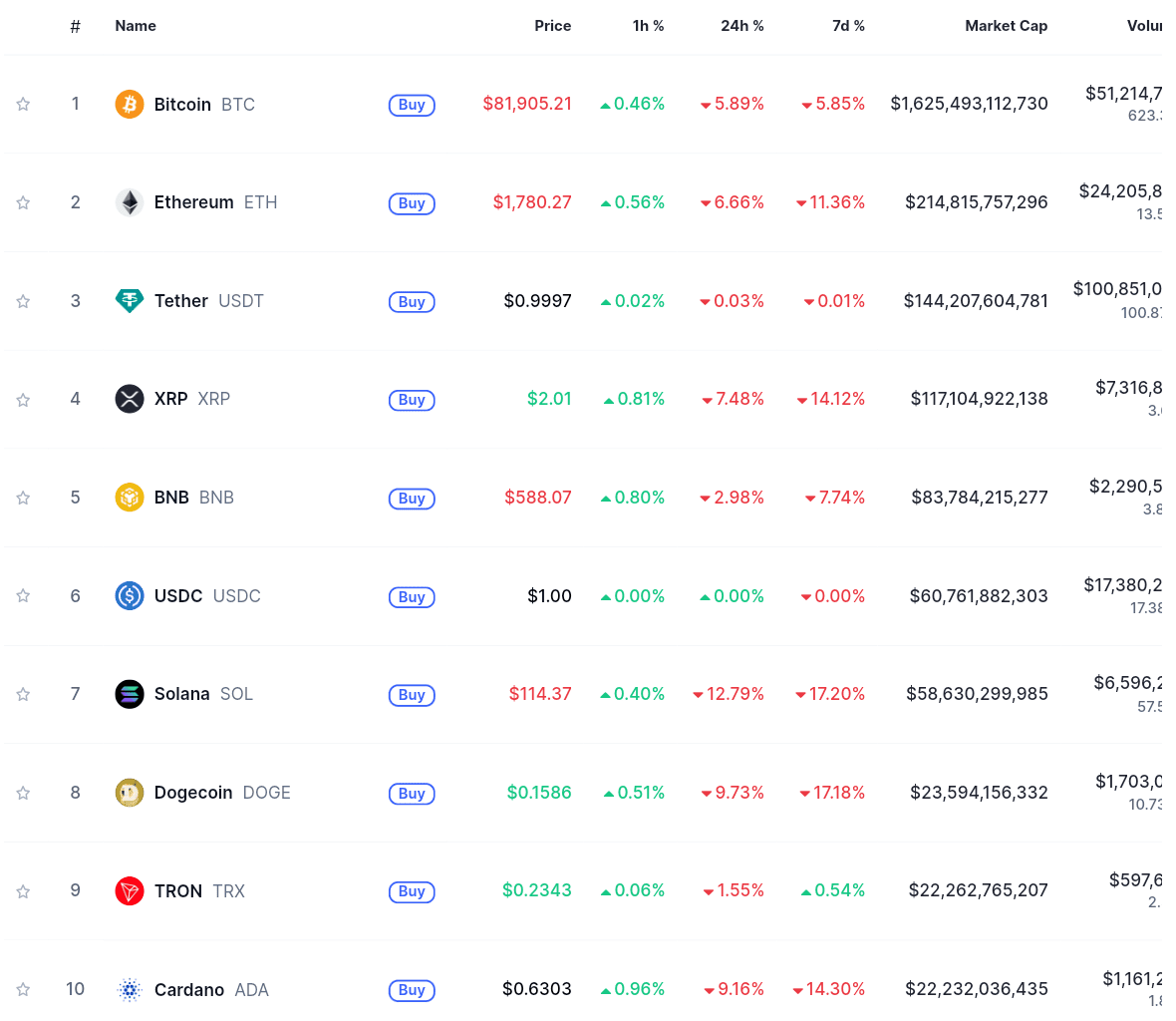

April 3, 2025: U.S. and Crypto Markets Dump After Tariff Shock

Global financial markets reacted negatively to Trump\’s newly announced tariffs. Key financial indexes saw steep declines:

- The Dow Jones Industrial Average fell by over 1,500 points (3.6%).

- The S&P 500 declined around 4%.

- The Nasdaq Composite dropped nearly 5%.

Bitcoin and other major cryptocurrencies experienced notable declines. Bitcoin fell as much as 4%, reaching approximately $82,000 on Thursday morning in Singapore. Other cryptocurrencies, including Ether and XRP, also saw declines, with Solana dropping over 9% at one point.

April 2, 2025: Trump Officially Launches \”Liberation Day\” Tariffs

President Trump officially announced the \”Liberation Day\” tariffs on this date. He called it a national emergency to protect American industry. The details of the new tariffs were:

- A 10% baseline tariff on all imports.

- A 34% tariff on goods from China.

- A 46% tariff on goods from Vietnam.

- A 20% tariff on goods from the European Union.

- A 10% tariff on imports from the United Kingdom, Australia, and other allied countries.

Trump said these tariffs would rebuild the American economy, bring back jobs, and lower taxes. But many countries criticized the move. The European Union and Australia expressed strong concerns, saying the tariffs would hurt global trade.

Trump\’s Trade War 2.0: The Background of Imposed Tariffs Explained

After winning the U.S. presidential election in November 2024, Donald Trump returned to the White House with a clear message: he wanted to fix America’s trade deficit and reduce dependency on foreign goods. Additionally, he promised to bring back American manufacturing jobs and make the country less reliant on countries like China. On February 1, 2025, just a few weeks after taking office for his second term, Trump signed his first major trade action. He imposed new tariffs on imports from China, Canada, and Mexico. The tariffs included:

- A 25% tariff on goods from Canada and Mexico,

- A 10% tariff on goods imported from China.

These tariffs officially took effect on Feb. 4. Trump said that these tariffs would protect U.S. industries, secure jobs, and balance trade. However, this decision immediately created tension with America\’s top trading partners. Canada, Mexico, and China all expressed concerns and warned that they might retaliate. Notably, throughout February and March 2025, the situation worsened. More tariffs followed, targeting specific countries. Specifically, China and Vietnam were accused of manipulating their currencies and giving unfair subsidies to their exporters. Trump and his team used this to justify even higher tariffs on these countries. As the tariff war heated up, financial markets also began to react. In particular, businesses, especially those that rely on imports or sell to international markets, started to suffer. Above all, investors are concerned that the tariff fight could lead to a trade war or even a recession.