The Loopscale hack caused a $5.8 million loss on April 26, marking a major Solana DeFi exploit in 2025. The Solana-based DeFi platform lost 12% of its total value after a flaw in its collateral pricing system was exploited.

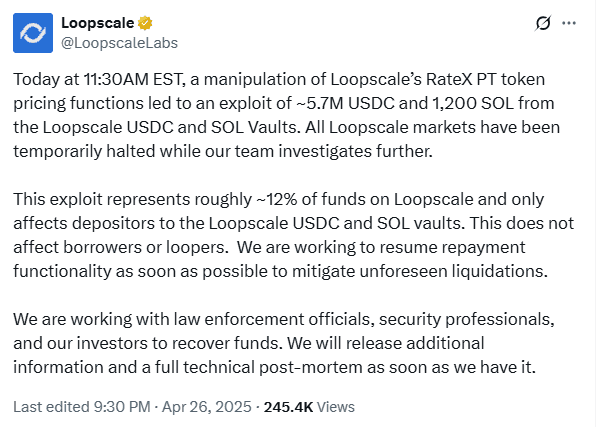

According to Loopscale co-founder Mary Gooneratne, the attacker took under-collateralized loans that drained the SOL and USDC Genesis vaults. The platform stated,

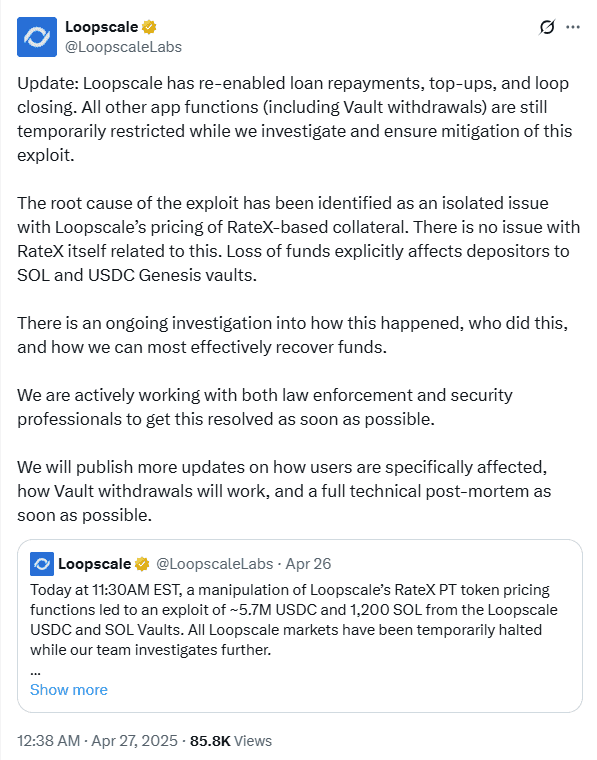

“The root cause of the exploit has been identified as an isolated issue with Loopscale’s pricing of RateX-based collateral. There is no issue with RateX itself related to this.”

Loopscale temporarily halted all markets after the hack. Partial operations resumed later, enabling loan repayments, loop closures, and top-ups. However, withdrawals from vaults remain suspended as assessments continue.

To retrieve the stolen assets, Loopscale proposed a bounty deal. The hacker was offered to keep 3,947 SOL (10% of stolen funds) if 90% of the assets were returned by April 28. Loopscale also warned of legal action if no response followed. The platform is now cooperating with security firms and law enforcement.

Term Finance Hack Leads to $1.5 Million Loss in Ethereum DeFi Exploit

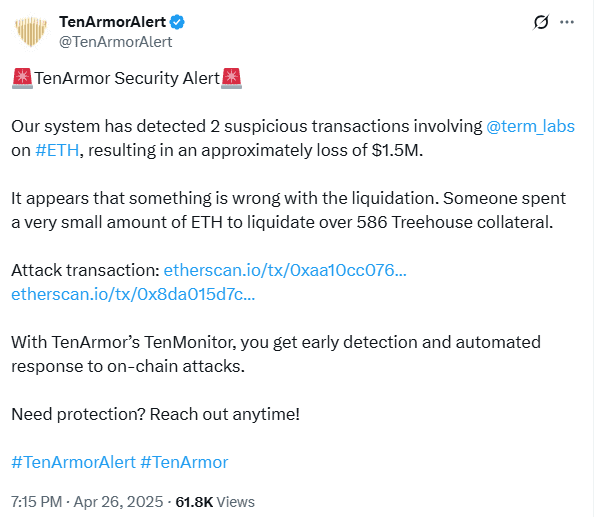

On the same day, the Term Finance hack added to growing DeFi exploits 2025. The Ethereum DeFi exploit resulted in $1.5 million lost due to a faulty update in Term Finance’s tETH oracle.

Blockchain security firm TenArmorAlert detected suspicious transactions involving Term Labs. The firm reported that an attacker spent a small amount of ETH to liquidate over 586 Treehouse collateral positions.

“It appears that something is wrong with the liquidation,”

TenArmorAlert stated.

Term Finance confirmed the incident and explained that no smart contracts were exploited. The problem remained isolated to tETH markets. The platform also committed to a full reimbursement for impacted users.

Other Term Finance funds outside the tETH markets stayed secure. The platform continues monitoring all operations while proceeding with compensation plans.

The crypto hacks 2025 wave continued with the Loopscale hack and Term Finance hack, pushing overall DeFi losses 2025 close to $2 billion.

Earlier this year, the Bybit exchange faced a $1.46 billion breach, one of the largest crypto hacks 2025 recorded so far. Together, these incidents highlight a rising trend of DeFi vulnerabilities.

Security researchers are increasingly reporting technical flaws as the primary cause of the breaches. These vulnerabilities continue to raise risks for users interacting with decentralized platforms in 2025.

Industry Voices Respond to Growing DeFi Exploits 2025 Concerns

Following the Loopscale hack and Term Finance hack, industry figures have pointed to risks in decentralized finance. Tim Haldorsson, founder of Lunar Strategy, raised concerns about returns versus risks in the DeFi sector.

Haldorsson stated,

“How safe is actually all this defi? We are chasing yield, but hack-adjusted is it actually better than just holding bonds.”

His comments reflect broader caution within the sector as users and platforms alike address growing losses from DeFi exploits 2025.

Loopscale’s bounty offer remains active until April 28, and Term Finance is proceeding with full reimbursements. Both projects continue working with blockchain security teams to address vulnerabilities and trace stolen funds.

The rise in crypto hacks 2025 keeps attention on the technical challenges facing DeFi platforms across both the Solana DeFi exploit and Ethereum DeFi exploit landscapes.