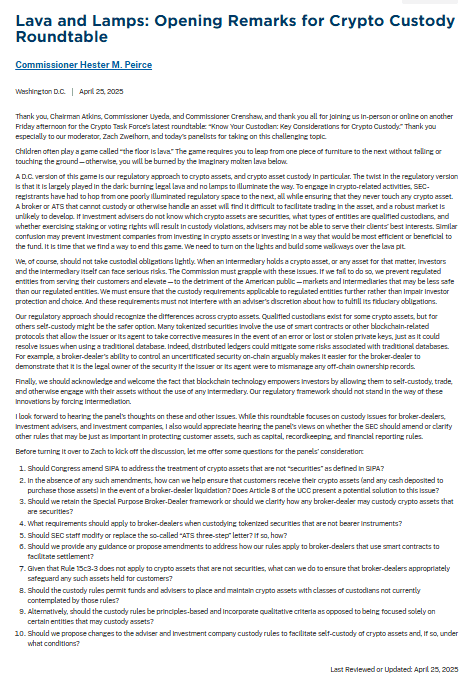

Hester Peirce, Commissioner and head of the SEC crypto task force, compared the current SEC crypto regulations to a dangerous and unclear game. Speaking at the “Know Your Custodian” roundtable event on April 25, she said U.S. firms must treat crypto like “the floor is lava,” but without lights.

“It is time that we find a way to end this game. We need to turn on the lights and build some walkways over the lava pit,”

Peirce said at the event.

Hester Peirce: Crypto Custody Feels Like Jumping Across Darkness

At the roundtable, Hester Peirce explained that crypto custody faces major regulatory confusion. She compared the situation to a game where touching crypto is like falling into lava.

In her speech, Peirce said that SEC-registered firms must jump from one unclear regulation to another while avoiding direct handling of crypto assets. They must make sure they never actually “touch” the assets, she added, because crypto asset custody rules remain poorly defined.

“A D.C. version of this game is our regulatory approach to crypto assets, and crypto asset custody in particular,” she said.

Investment advisers, according to Peirce, often do not know which assets are securities or who can serve as qualified custodians. She said that even activities like staking or voting rights could cause unexpected custody issues.

“The twist in the regulatory version is that it is largely played in the dark: burning legal lava and no lamps to illuminate the way,” Peirce explained.

Mark Uyeda Urges for Broader Custodial Options for Crypto Firms

During the same event, Mark Uyeda, also an SEC Commissioner, shared similar concerns. He said that as more SEC-registered companies deal with crypto assets, they must have custodial options that fit legal requirements.

Uyeda proposed that the SEC should allow state-chartered limited-purpose trust companies to act as qualified custodians for crypto assets. This would give firms an alternative to the few available custodial services.

Peirce pointed out that without proper crypto custody solutions, brokers and Alternative Trading Systems (ATS) cannot easily trade crypto assets. This makes it harder for the crypto market to grow under the existing system.

Both Hester Peirce and Mark Uyeda described the situation as limiting for companies that want to handle crypto assets within regulatory bounds.

Paul Atkins Calls for Clearer SEC Crypto Regulations

Meanwhile, SEC Chair Paul Atkins also spoke at the Know Your Custodian event. He said blockchain technology could bring efficiency, better risk control, more transparency, and lower costs.

Atkins stressed that one of his priorities is creating clear SEC crypto regulations for digital assets. He said the SEC needed to work closely with the crypto market participants to fix gaps left by earlier approaches.

“I look forward to engaging with market participants and working with colleagues in President Trump’s administration and Congress to establish a rational fit-for-purpose framework for crypto assets,” Atkins said.

Atkins also suggested that the leadership under former SEC Chair Gary Gensler may have added to market confusion, although he did not give further details.

Throughout the event, speakers focused on the urgent need for clear frameworks around crypto asset custody and qualified custodians to ensure the crypto market can develop securely under U.S. law.