NOIDA (CoinChapter.com) — Cardano (ADA) price has struggled to find its footing since April 25, failing to keep pace with a broader cryptocurrency market rebound. As Bitcoin price reclaimed the $95,000 level before retreating slight and Ethereum price held steady above $1,700, ADA remained pinned near $0.74, extending its steady downtrend.

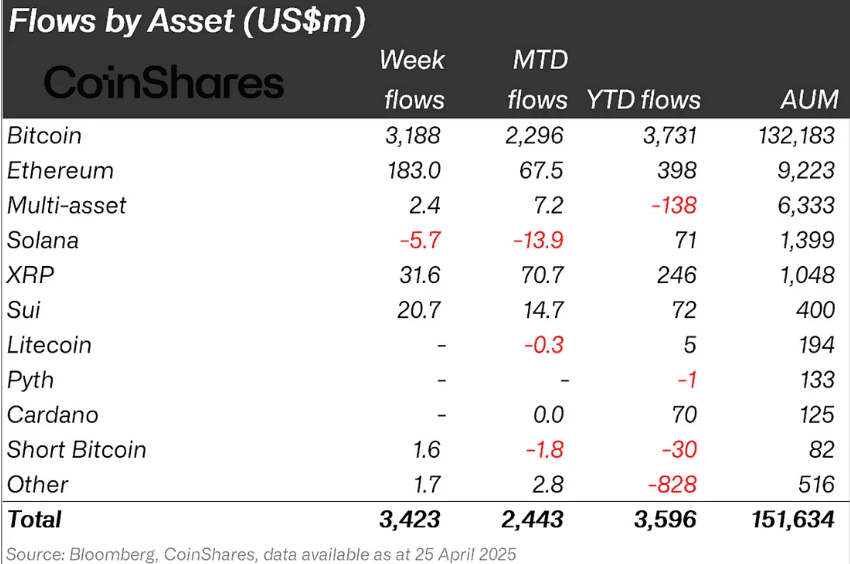

While leading altcoins like Solana and XRP recorded net gains during the same period, Cardano’s price action reflected persistent investor hesitation. Institutional appetite for ADA has also remained muted. According to the latest CoinShares report, Cardano-linked investment vehicles recorded zero net inflows last week, signaling either growing apathy or underlying mistrust from professional investors.

Meanwhile, assets like Bitcoin, Ethereum, and XRP continued attracting substantial institutional capital. This divergence paints a stark picture for Cardano’s near-term prospects, suggesting that broader market optimism has yet to translate into renewed confidence in ADA.

Adding to the mix, Cardano co-founder Charles Hoskinson recently addressed the community during an April 25 livestream, offering a bold vision for the network’s future. Yet with ADA’s price action struggling to reflect that optimism, the question remains whether Cardano can actually deliver on its promises, or whether investor skepticism will continue to weigh heavily on its recovery.

Hoskinson’s Big Dreams Meet a Tough Reality

Charles Hoskinson, Cardano’s co-founder, laid out an ambitious roadmap during his April 25 livestream, projecting that ADA could surge to $3, $5, or even $10. He linked this potential to the success of a major budget proposal seeking 50–70 million ADA to fund Input Output Global’s 2025 plans.

Hoskinson framed this funding as critical for unlocking a new phase of Cardano’s growth, driven by breakthroughs in scalability, privacy, governance, and a stronger developer ecosystem. Among the key initiatives, Hoskinson highlighted Leios, a scalability upgrade that could significantly boost the blockchain’s transaction throughput without sacrificing decentralization.

The Cardano founder emphasized the importance of roll-up solutions designed to enhance network efficiency. Hoskinson also placed major weight on the Midnight partner chain, a privacy-focused sidechain aimed at onboarding millions of users seeking confidential blockchain interactions.

If successful, Midnight could transform Cardano into the largest Active Validation System (AVS) in crypto, a status Hoskinson believes would increase ADA’s utility and market value.

Additionally, Hoskinson outlined a $13.4 million research proposal targeting innovations in Ouroboros consensus, Hydra scaling solutions, and quantum-resistant cryptography. He stressed that maintaining scientific leadership was non-negotiable for Cardano’s success, positioning the project to weather future competitive threats.

The Cardano chief’s broader strategy envisions a thriving ecosystem where increased total value locked (TVL) and an expanded developer base drive sustained ADA demand.

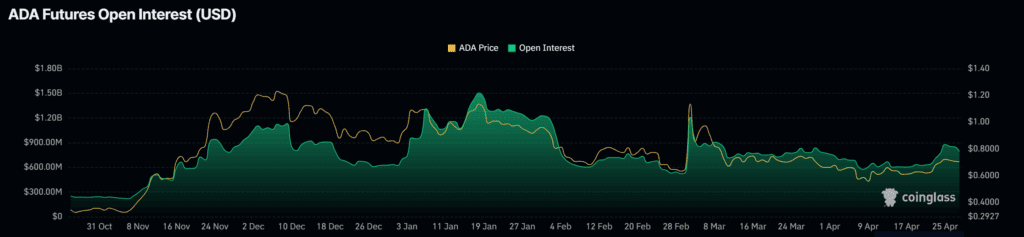

However, the market’s reaction so far has been cautious. Since the livestream, ADA’s futures open interest has declined, slipping under $800 million despite broader growth in crypto leverage markets. CoinShares data also recorded zero net inflows into Cardano-linked products, hinting at investor skepticism.

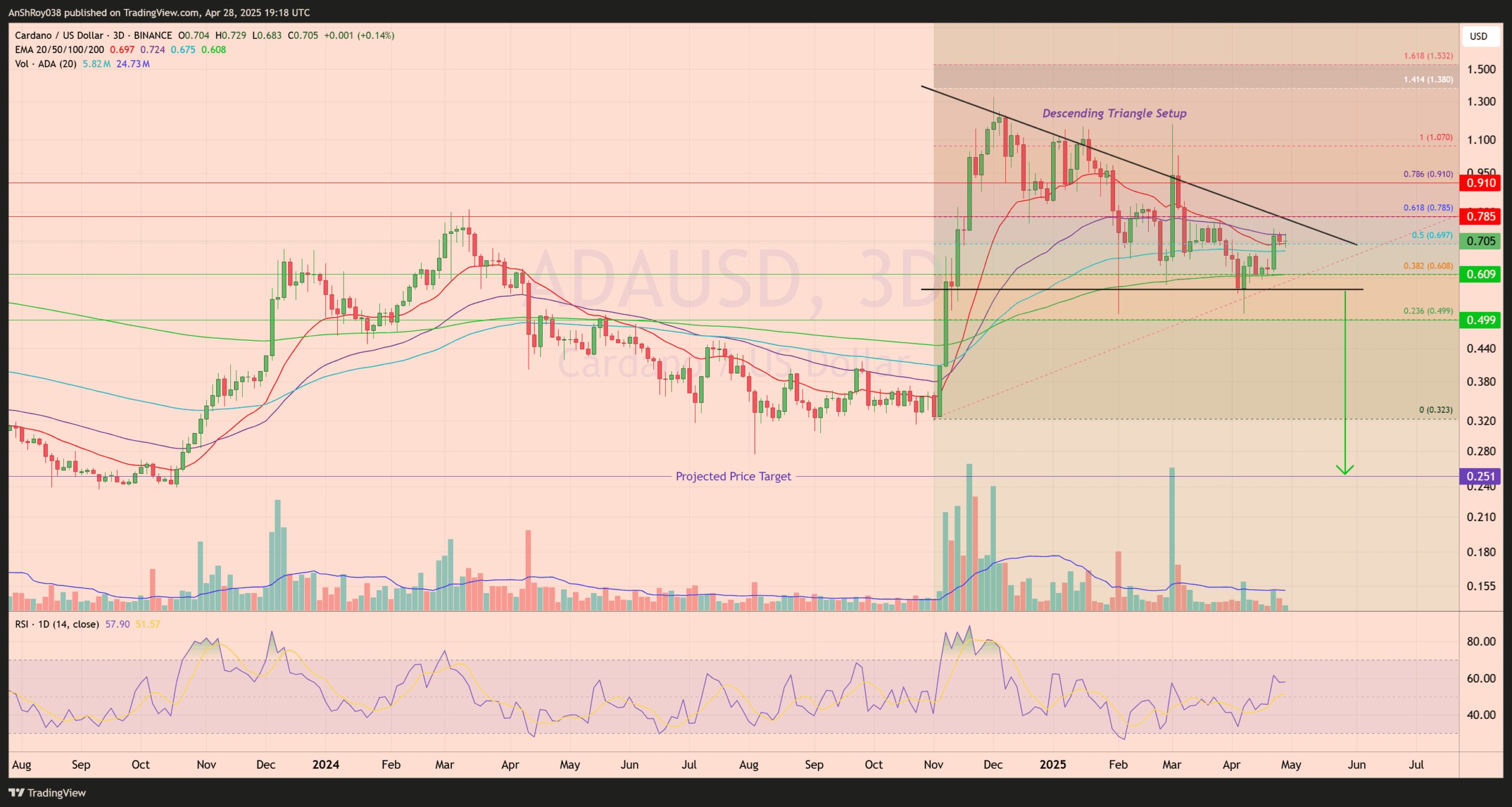

Descending Triangle Breakdown Looms Over ADA Price

The ADA USD pair has formed a descending triangle setup. The bearish continuation pattern typically signals a loss of buyer momentum. An asset’s price prints lower highs in a descending triangle while holding horizontal support.

Sellers gradually tighten control as rebounds weaken, often leading to a breakdown when support finally gives way. Traditionally, traders calculate the pattern’s theoretical price target by measuring the distance between the pattern’s initial high and the flat base, then extending that range downward from the breakdown point.

The Cardano token’s price traded just above its 200-day EMA (green) trendline, near $0.61, acting as immediate support. The 100-day EMA (blue) acts as dynamic support. A decisive close below these moving averages would expose ADA price to the descending triangle’s horizontal support near $0.574.

Breaking this floor would confirm the bearish setup and trigger a deeper correction toward the 0.236 Fib level support near $0.5.

Although the triangle’s technical target lies much lower, ADA must first breach these key support zones to unlock extended downside risk. On the upside, multiple resistance levels continue to cap rallies. A bull run from here would face resistance near $0.785. Flipping the immediate support would open the path for the Cardano token to challenge the resistance near $0.9.

Repeated rejections from the descending trendline highlight ongoing selling pressure. Meanwhile, the RSI indicator shows weakening bullish momentum despite short-term recoveries, raising further caution.

While Hoskinson sees a future with a $3, $5, or $10 per token ADA price, at the moment, the Cardano token continues trading in cents. And if the bearish setup has its way, ADA has a long way to go before it can live up to the Cardano founder’s expectations.