SUI price posted a robust recovery this week, rising nearly 70% in the past seven days. The Layer-1 blockchain token outperformed the broader crypto market, fueled by surging decentralized finance (DeFi) activity, rising stablecoin supply, and renewed technical momentum.

DEX Volume and TVL Surge as SUI Defies the Market

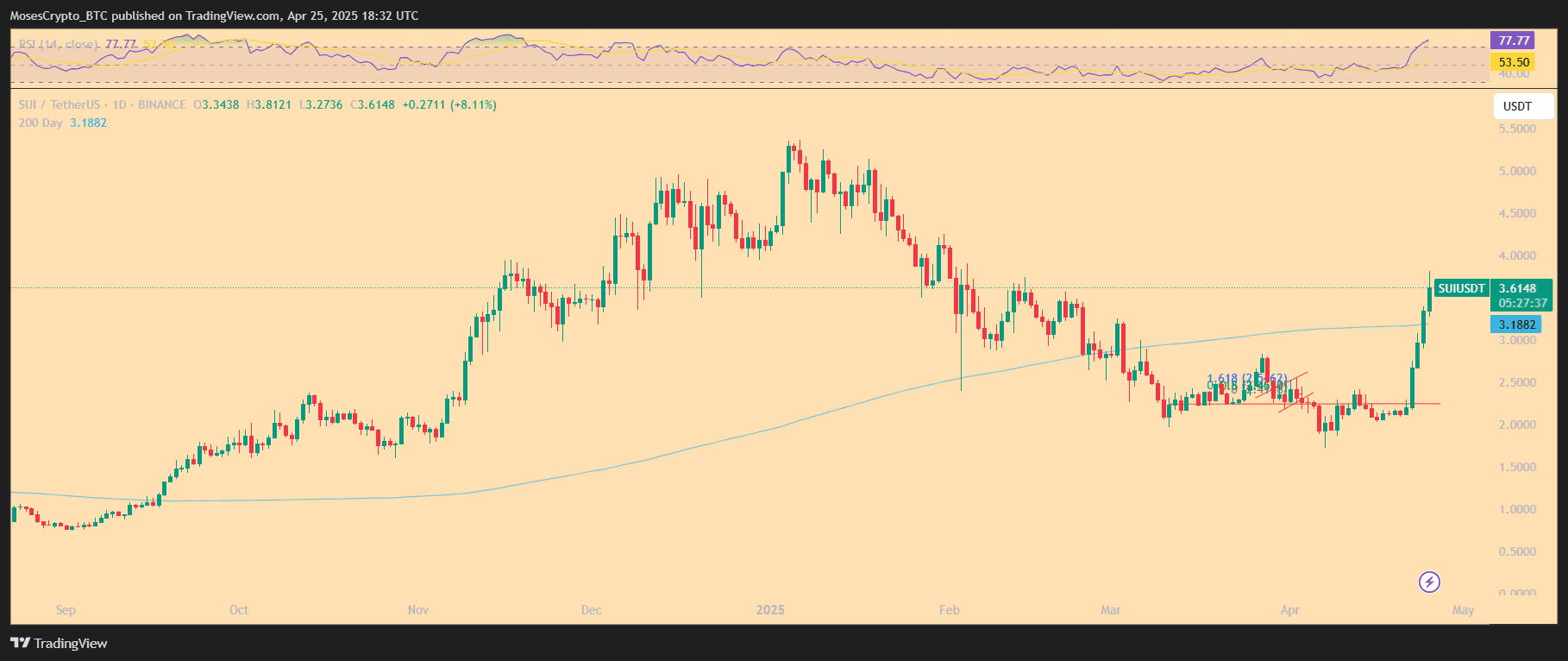

SUI traded at $3.55 on Apr. 25, reflecting a 16.88% gain in the past 24 hours. The token climbed sharply from a low near $2 earlier in the month, posting five consecutive bullish daily candles.

According to DefiLlama, total value locked (TVL) on SUI grew 9.64% this week, reaching $1.595 billion. Meanwhile, decentralized exchange (DEX) volumes surged 38.51% over the past seven days, climbing to $2.77 billion. The 24-hour DEX volume stood at $806.16 million.

Stablecoins circulating on the SUI blockchain also expanded rapidly. The stablecoin market capitalization rose 7.81% over the past week to $865.2 million, with USD Coin (USDC) dominating 71.64% of the supply.

LookOnChain reported that stablecoins on SUI rose from $482 million to $879 million over the past two months, an 82% increase. The data highlighted rapid ecosystem growth supporting the bullish breakout.

SUI Price Eyes $5 as Technical Breakout Accelerates

As detailed in recent SUI price analyses, the token completed a breakout from a falling wedge pattern, historically a bullish setup.

SUI surged past the 200-day exponential moving average (EMA) and cleared the 23.60% Fibonacci retracement near the $3 psychological mark. Momentum indicators, including the MACD and histogram readings, shifted sharply positive, suggesting growing buyer strength.

Crypto trader Captain Faibik called attention to SUI’s technical setup earlier this week, noting it was “on the verge of a potential massive breakout.” The breakout materialized quickly, pushing the token up over 60% since the initial signal.

Friedrich forecasted a $7 cycle top for SUI, citing the strong recovery and growing network adoption as key catalysts.

Ecosystem Revival Drives Investor Interest

Beyond price action, the SUI blockchain recorded sharp growth in ecosystem activity. LookOnChain highlighted that DEX volume jumped 177% in a week to $599 million as of Apr. 25, while TVL increased 38% in the same timeframe, reaching $1.645 billion.

Stablecoins grew 82% over two months, reinforcing user adoption across DeFi protocols built on SUI. Captain Faibik noted the trend earlier, urging traders to “keep a close eye” on the token following early signs of ecosystem strength.

The native $SUI token, built on the Move programming language, leverages an object-centric model for faster, parallel transaction processing. This design makes SUI an attractive blockchain for decentralized applications (dApps) in DeFi, gaming, NFTs, and social networking.

As reported by Friedrich, SUI’s architecture supports low-latency transactions and scalability, allowing it to compete with larger Layer-1 chains.

While bullish momentum remains intact, traders watch for potential volatility at key technical levels. SUI broke out past the $3 resistance zone, but analysts eye the next major target at $5.29, corresponding to a 50% Fibonacci extension from the recent breakout.

A retest of the broken $3 support zone could provide a buy-the-dip opportunity if selling pressure emerges.