Bitcoin is up over 150% in 2023, and that momentum has captured hearts and minds on Wall Street, resulting in a landmark rush for its firms to launch the first-ever Bitcoin exchange-traded fund (ETF).

All eyes are now on the upcoming decision by the U.S. Securities and Exchange Commission (SEC) regarding the approval of a spot Bitcoin ETF, slated for January 10.

If the past is any indication, the ruling will have a significant impact on Bitcoin’s price, though whether positive or negative remains to be seen.

Potential for a Price Rise

Proponents of a Bitcoin ETF argue that its approval by the SEC would open the door to a flood of institutional and retail investments, driving the price of Bitcoin to new heights.

History offers a glimpse into how expectations surrounding ETFs have affected Bitcoin’s price.

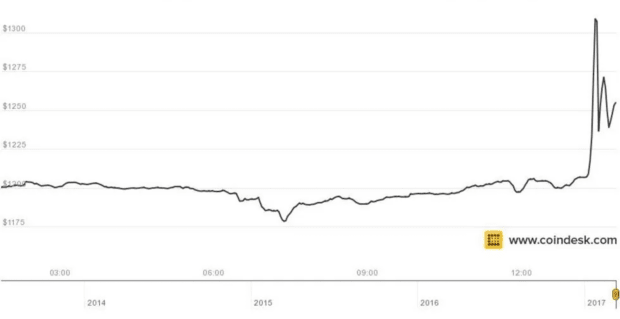

In 2017, the price of Bitcoin surged to over $1,400, driven in part by the anticipation of the first Bitcoin ETF. This was up from lows in the $600 range just the year before.

Investors believed then that the introduction of a Bitcoin ETF would make it easier for institutional money to enter the market, leading to a frenzy of buying. However, the SEC ultimately rejected the proposal, causing a sharp decline in Bitcoin’s price.

Within days, the price was trading back below $1,000.

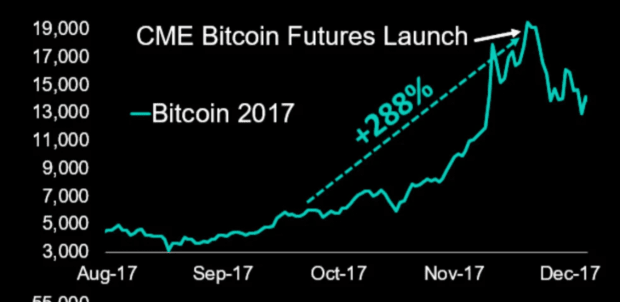

Ultimately, however, the arrival of Bitcoin futures would bring new attention in 2017, the market surging above $20,000 that year.

Elsewhere, we can fast forward to 2021, when Bitcoin once again rallied to all-time highs, reaching over $60,000.

This time, the rally was partly fueled by the successful launch of Bitcoin futures ETFs in Canada and Europe. These ETFs allowed investors to gain exposure to Bitcoin without holding the cryptocurrency directly. The anticipation of a similar product in the U.S. contributed to the bullish sentiment.

Finally, in the wake of fake news of an ETF approval earlier this year, Bitcoin’s price rose by several thousand dollars in minutes, a move that suggests upside volatility on approval is likely.

Potential for a Price Fall

On the flip side, there are arguments suggesting that the approval of a Bitcoin ETF could lead to a price correction.

Some market experts fear that the ETF could become a target for short sellers, leading to increased volatility, or that the ETF could be a “sell the news event.”

Moreover, the approval of a Bitcoin ETF may bring greater regulatory scrutiny to the cryptocurrency market as a whole. This heightened oversight could lead to increased taxation, reporting requirements, and potential restrictions on the use of Bitcoin, which may dampen enthusiasm among investors.

Additionally, some believe the market may already have priced in the possibility of a Bitcoin ETF approval, and any decision to deny it might lead to disappointment and a sell-off similar to what was witnessed in 2017 when the Winklevoss Bitcoin ETF was rejected.

The final decision by the SEC is eagerly awaited by the crypto community, but it’s essential to remember that it is just one of many factors influencing Bitcoin’s price.

Market sentiment, macroeconomic conditions, and geopolitical events will also play their part in shaping the coin’s future.

Conclusion

In conclusion, Bitcoin’s price is at a crossroads as investors await the SEC’s decision on the Bitcoin ETF.

While past instances have shown that ETF expectations can have a substantial impact on Bitcoin’s price, it is crucial to consider the broader market dynamics. Whether Bitcoin’s price rises or falls after the SEC ruling will depend on a multitude of factors, including how the market interprets and reacts to the decision.

As the crypto world holds its breath, the future of Bitcoin remains uncertain, but it’s undeniably a pivotal moment for the world’s only decentralized cryptocurrency.